Alabama legislators have introduced a package of three bills aimed at reforming the state’s approach to data center incentives and utility regulation. Presented on February 5, 2024, these proposed measures seek to protect consumers from potential cost increases associated with large data centers, which have recently expanded in the state due to attractive tax breaks and low electricity costs.

The first bill, designated as Senate Bill 270, is sponsored by Sen. Bell. This legislation mandates that utilities charge large data centers for the additional costs incurred due to their significant energy consumption. The requirement particularly targets facilities consuming at least 150 megawatts of electricity—an amount sufficient to power approximately 112,000 homes. The bill stipulates that these arrangements must benefit other customers rather than increase their expenses, focusing on whether the rates set for data centers can lead to lower costs for the broader consumer base and improve grid efficiency.

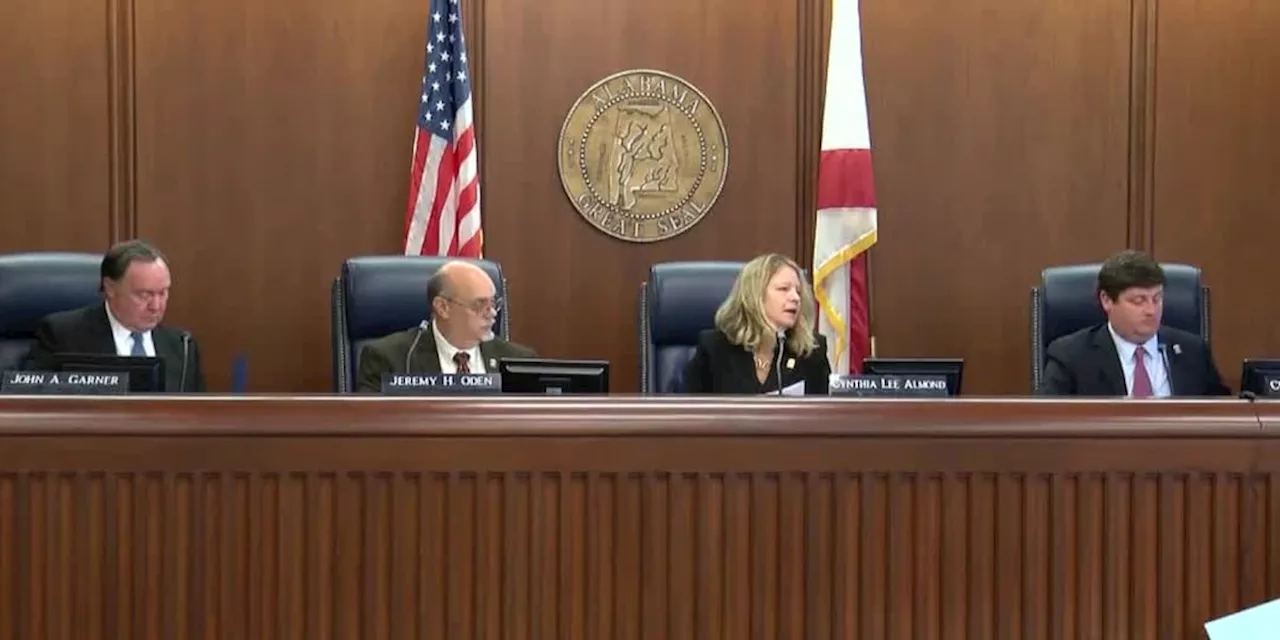

Additionally, Senate Bill 268 proposes significant changes to the governance of the Alabama Public Service Commission. The current system, which allows for public elections of commissioners, would be replaced by a model where political leaders appoint members to the commission. Starting in 2028, the governor would appoint the commission president, while the House Speaker and Senate President Pro Tempore would select associate commissioners two years later. This bill also aims to enhance conflict of interest regulations, extending restrictions beyond utility companies to include any organization seeking business before the commission. Notably, the bill would prohibit utilities from passing lobbying expenses onto customers. Daniel Tait, Executive Director of Energy Alabama, criticized the proposal, stating, “If the Alabama Power Grab passes, the public loses oversight and the utility gains insulation once and for all.”

The third bill, Senate Bill 265, targets the state’s lucrative tax incentives for data centers. Under current law, major projects can receive tax breaks lasting up to 30 years. This new proposal would limit such incentives to 20 years for agreements initiated after January 1, 2027. Furthermore, large data centers using at least 100 megawatts of energy would be required to pay state sales taxes on their purchases, though exceptions could be made for facilities located in economically disadvantaged areas.

The legislation also extends the timeline for the expiration of existing tax breaks for data centers from 2028 to 2032. The revenue generated from the newly imposed sales taxes would contribute to the state’s general fund, diverging from previous allocations that benefitted education funding.

Alabama has attracted multiple significant data center projects in recent years, primarily due to its low energy costs and substantial tax incentives. However, the rising energy demands of these facilities have raised concerns about the financial impact on ordinary customers.

All three bills are currently under review by the Senate Committee on Fiscal Responsibility and Economic Development. If approved, they would come into effect at varying times in 2026. The outcome of these proposals could reshape the landscape for data centers and utility regulation in Alabama, potentially ensuring that everyday consumers are not burdened by the costs associated with these large energy users.