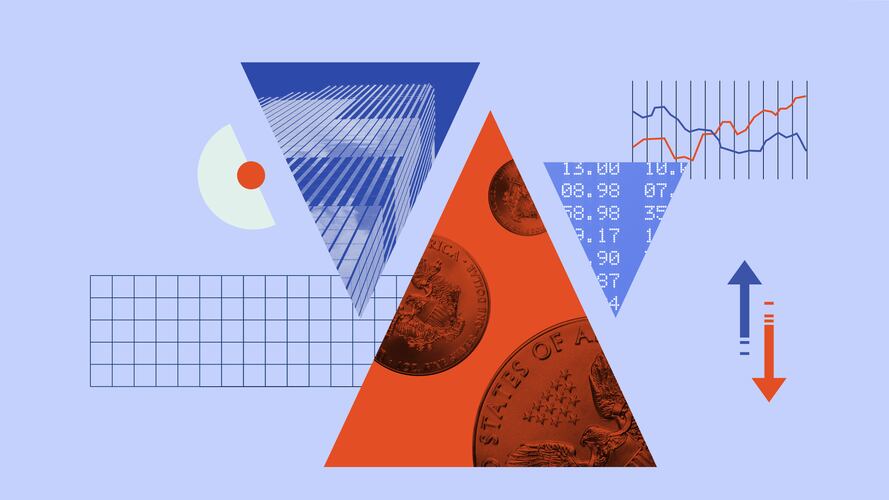

UPDATE: Vanguard has just announced the launch of three new active fundamental stock exchange-traded funds (ETFs) aimed at enhancing its competitive edge in the rapidly evolving investment landscape. This significant move, revealed earlier today, marks Vanguard’s first foray into actively managed ETFs guided by bottom-up stock-pickers, particularly overseen by its long-time partner, Wellington Management.

As asset managers face persistent outflows from actively managed mutual funds, Vanguard’s decision reflects a crucial shift in investor behavior. Over the past decade, there has been a notable trend towards cheaper and more tax-efficient ETFs, making this launch not just timely but essential for Vanguard’s strategy. The new ETFs promise lower fees for investors and a more tax-efficient investment vehicle, which typically leads to better long-term performance.

The three new funds include:

1. **Vanguard Wellington Dividend Growth Active ETF (VDIG)** – Drawing from the investment strategy of the Vanguard Dividend Growth Fund.

2. **Vanguard Wellington U.S. Growth Active ETF (VUSG)** – Managed by Michael Masdea and Brian Barbetta, this fund will focus solely on U.S. stocks, using strategies similar to the Wellington sleeve of the Vanguard Global Equity Fund.

3. **Vanguard Wellington U.S. Value Active ETF (VUSV)** – Overseen by David Palmer, this fund will employ a process akin to that used for Wellington’s portion of the Vanguard Windsor Fund.

Each ETF is designed to maintain a Vanguard-like fee structure, with the expected expense ratios for VUSG and VUSV landing near the bottom decile of their respective categories for large-growth and large-value funds. This commitment to affordability is expected to attract a broader investor base.

Vanguard’s entry into actively managed ETFs is not unprecedented; the firm has previously offered a limited range of rules-based stock ETFs and has expanded its presence in actively managed bond ETFs. However, with only $15 billion in actively managed ETFs as of July 2025, this new initiative signals a more aggressive approach as the firm navigates a fiercely competitive ETF landscape.

The success of these ETFs will depend heavily on the distribution plans and the investment processes employed. As more asset managers pivot towards ETFs and competition intensifies, Vanguard’s ability to innovate and deliver value will be crucial. This development is expected to resonate strongly with investors seeking better performance and lower costs.

As Vanguard takes this bold step, all eyes will be on the performance of these funds in the coming months. Investors and analysts alike will be monitoring how these changes impact Vanguard’s market position and investor sentiment in a climate increasingly favoring ETFs over traditional mutual funds.

Stay tuned for more updates as this story develops.