URGENT UPDATE: The U.K. government has just confirmed a massive £1.5 billion ($2 billion) loan to Jaguar Land Rover (JLR) as the carmaker grapples with the fallout from a debilitating cyberattack that halted production for weeks. This unprecedented move is set to bolster JLR’s cash reserves and protect an estimated 120,000 jobs within the broader supply chain that relies on the company’s operations.

The announcement came following weeks of turmoil for JLR, which was forced to shut down its production lines on August 31 after hackers infiltrated its systems. The shut down left numerous suppliers at risk of bankruptcy and raised alarms across the U.K. manufacturing sector. In a statement released on Sunday, U.K. ministers emphasized that the loan would support JLR’s supply chain, severely impacted by the operational pause.

JLR reported a staggering £50 million loss due to the shutdown, but with a pre-tax profit of £2.5 billion in 2024, the company is poised to recover. However, the financial support from the government marks the first time a U.K. firm has received assistance following a cyberattack, raising questions about cybersecurity standards across the sector.

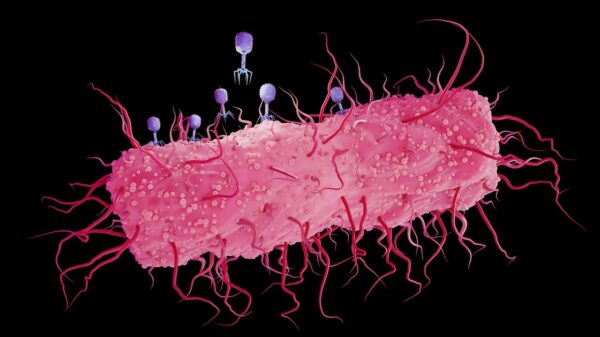

The attack has been attributed to a financially motivated crime group known for previously targeting the U.K. retail sector. JLR confirmed that some company data was stolen, forcing employees to remain at home while the network was rebuilt. Experts are warning that the government’s intervention could inadvertently encourage hackers to target U.K. organizations, believing they may receive similar bailouts if they succeed.

Critics have also pointed to JLR’s decision to outsource its cybersecurity operations to Tata Consulting Services (TCS), which may have contributed to the breach. TCS, already in the spotlight for its involvement in hacks against major retailers like Marks & Spencer and the Co-op, is now under scrutiny as the potential point of intrusion for the cybercriminals.

In a recent communication, JLR has assured stakeholders that it plans to resume car production “in the coming days,” although it has already missed several deadlines for recovery. The urgency for a swift return to normalcy cannot be overstated, as the livelihoods of thousands hang in the balance.

As the situation continues to unfold, all eyes are now on JLR’s recovery efforts and the government’s handling of cybersecurity in critical industries. The implications of this loan and the broader impacts on the automotive sector will be closely monitored in the coming weeks.

Stay tuned for developing updates on this urgent situation.