URGENT UPDATE: New reports from Goldman Sachs reveal that despite the overwhelming buzz around artificial intelligence (AI), major corporations are not seeing a meaningful impact on their profits. In a report released just yesterday, analysts highlighted that while 58% of S&P 500 companies discussed AI in their second-quarter earnings calls, the financial benefits remain elusive.

The findings come amidst a backdrop of skyrocketing stock prices for AI-linked companies, which are up 17% this year alone. This follows a remarkable surge of 32% in the previous year, fueled by substantial investments from tech giants like Nvidia, Amazon, Microsoft, and Google. However, Goldman analysts caution that the excitement surrounding AI has not yet translated into tangible profits for most firms.

Despite the fervor, the report indicates that only a fraction of companies are quantifying AI’s impact on their earnings. A staggering 80% of firms surveyed by McKinsey reported that generative AI has yet to significantly influence their bottom lines.

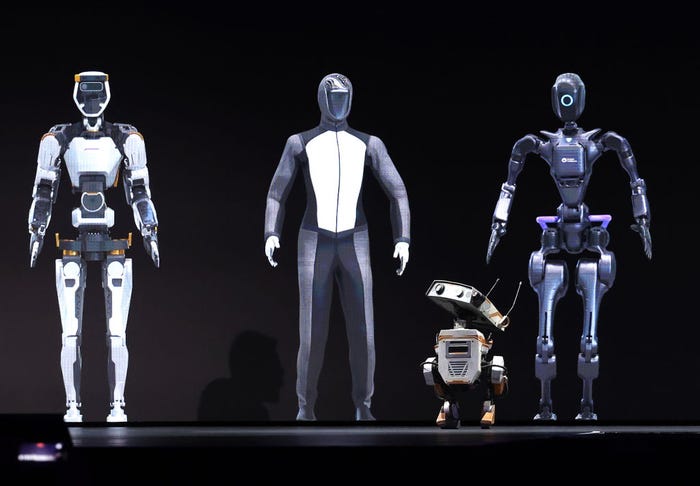

The S&P 500 is now trading at one of its most inflated valuations in history, paralleling the heights of the dot-com bubble, but still falling short of the peaks seen during the tech boom of 2021. Goldman Sachs identifies the current market phase as driven by “hyperscalers” — major players expected to collectively invest $368 billion in capital projects by 2025, a notable increase from $239 billion in 2024.

Goldman Sachs outlines a four-phase approach to understanding the AI market. The first phase was led by Nvidia, whose chips are pivotal for AI operations. The market currently finds itself in Phase 2, where the hyperscalers reign. Moving forward, the third phase involves integrating AI into products, a challenging endeavor as investors fear potential price reductions and new competitors.

Analysts warn that if AI investment levels revert to 2022 figures, the consequences could be severe, potentially reducing sales forecasts by $1 trillion and impacting the S&P 500 by as much as 20%.

As the AI conversation intensifies, the risk remains that hype may outpace reality. Goldman Sachs emphasizes the need for companies to demonstrate clear, quantifiable earnings improvements to maintain investor confidence in this rapidly evolving sector.

As companies continue to explore AI’s potential, all eyes will be on how these developments influence not only stock prices but also the broader economy in the coming months. Investors and industry leaders alike are urged to remain vigilant as the landscape continues to shift dramatically.

Stay tuned for more updates as this story develops.