The landscape of investment is shifting, with a growing number of young investors gravitating toward cryptocurrency. A recent survey by Gemini reveals that **51%** of Generation Z respondents in the United States reported ownership of cryptocurrency, a significant increase compared to only **29%** of Generation X. This surge reflects a broader trend among young individuals who are increasingly viewing digital assets as a hedge against job displacement, rising living costs, and a declining faith in traditional financial institutions.

The appeal of cryptocurrencies, particularly Bitcoin, has intensified amid concerns about the potential for **AI-driven job displacement** and the **Federal Reserve’s** diminishing independence. Wall Street veteran **Jordy Visser** highlighted these issues in an interview, warning that “digital employees” like AI bots could replace many roles, leaving young workers to adapt to a restructured job market. He pointed out, “They’re not going to hire as much. The people who are hired will be digital employees.”

As the Federal Reserve faces political pressure to adjust interest rates, doubts about the stability of the US dollar have emerged. Visser noted that if the Fed succumbs to fiscal influences, long-term trust in the dollar could wane. In this context, Bitcoin’s capped supply of **21 million coins** and its independence from central banks are increasingly attractive features for investors seeking stability.

Shifting Perceptions of Wealth and Ownership

Cryptocurrencies resonate particularly well with a mobile-first generation. They offer features such as easy self-custody and borderless transfers, appealing to young investors who prefer autonomy over their financial assets. **Michael Saylor**, executive chairman of MicroStrategy, argues that Bitcoin embodies a “new American Dream,” replacing traditional homeownership with digital asset ownership.

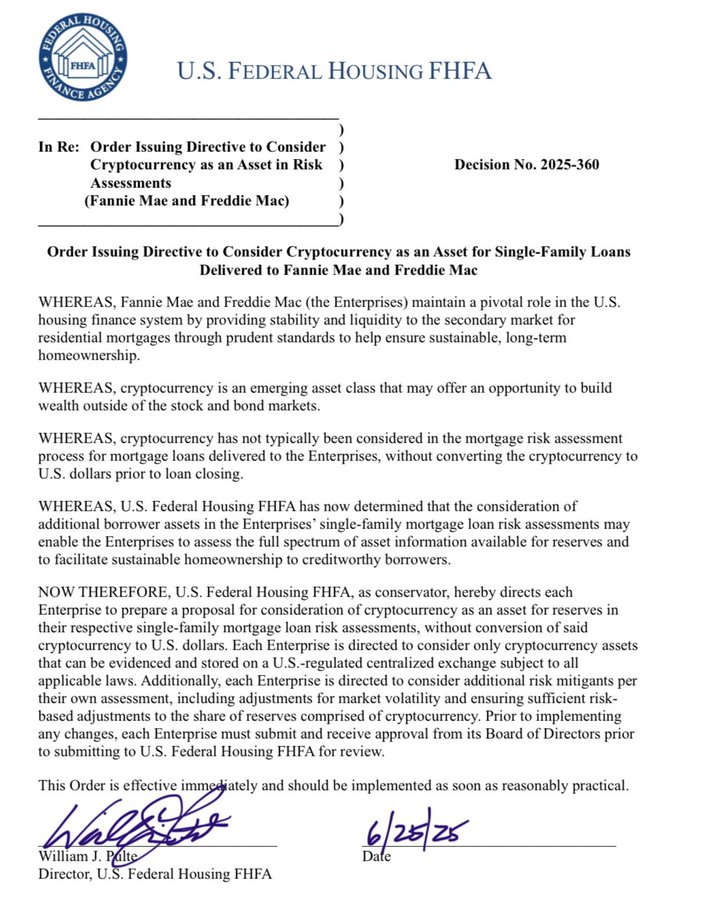

The trend gained further momentum following a directive from **William Pulte**, Director of the Federal Housing Finance Agency, who instructed **Fannie Mae** and **Freddie Mac** to develop proposals for incorporating cryptocurrency holdings into mortgage assessments. This initiative requires that only cryptocurrencies stored on US-regulated exchanges be considered, while also addressing the inherent volatility of such assets. Experts believe this move could allow younger homebuyers to manage their assets without incurring tax penalties from liquidation.

The Gemini survey indicates that **34%** of Generation Z prefer using cryptocurrency over cash, the highest rate among all age demographics. Additionally, **33%** of Gen Z respondents expressed comfort with allocating at least **5%** of their portfolio to crypto, compared to **21%** of the general US population. Another report suggests that by **2025**, **42.3%** of US Gen Z individuals will hold cryptocurrencies, marking them as the leading age group in this asset class.

From Speculation to Strategic Investment

What began as speculative trading has evolved into a more strategic approach among young investors. Bitcoin and Ethereum are increasingly viewed as essential components of investment portfolios, serving as hedges against inflation and uncertainty. An asset management executive noted that “Crypto is becoming an institutional tool,” reflecting a shift in perceptions about digital assets.

As **Fannie Mae** and **Freddie Mac** consider integrating cryptocurrencies into traditional financial frameworks, the embrace of digital assets by Generation Z signals a pivotal change in wealth-building strategies. This emerging trend suggests that what once seemed like a passing phase is now likely to redefine the concept of the American Dream for years to come.

The growing enthusiasm for cryptocurrency among young investors highlights not only their adaptive strategies in response to economic challenges but also a significant cultural shift towards digital finance. As regulatory clarity improves and institutions begin to adapt, the integration of cryptocurrencies into mainstream financial practices appears to be on the horizon.