EnerSys (NYSE: ENS) announced a notable increase in its first-quarter fiscal 2026 revenue, driven by the acquisition of Bren-Tronics, heightened demand in data centers, and a recovery in the U.S. communications sector. The company’s revenue rose by 4.7% year-over-year to $893 million, surpassing initial guidance. Despite this growth, the adjusted diluted earnings per share reached $2.08, a 5% increase from the previous year. However, the base business earnings per share, excluding tax credit benefits from IRC 45X, decreased by 6% to $1.11 due to challenges such as foreign exchange fluctuations and order delays in the forklift and transportation markets.

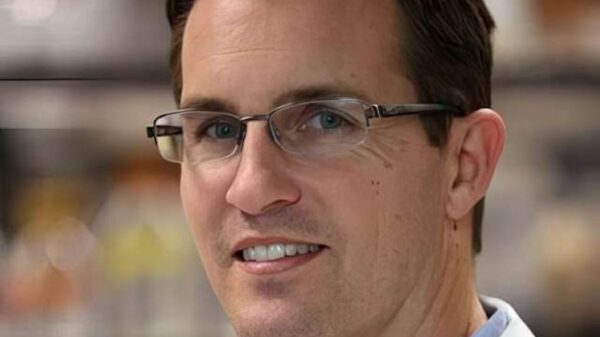

In response to these challenges, President and CEO Shawn O’Connell introduced the “EnerGize” strategic framework. This initiative aims to enhance operational efficiency and agility, starting with a workforce reduction and organizational restructuring expected to yield annualized savings of $80 million. O’Connell emphasized that this effort extends beyond mere cost-cutting, positioning EnerSys for sustainable long-term growth.

Shareholder Returns and Future Outlook

EnerSys also expanded its capital return strategy, announcing a $1 billion increase to its stock repurchase authorization, bringing the total available for buybacks to $1.06 billion. Additionally, the company raised its dividend by 9% to $0.2625 per share, marking the third consecutive annual increase. In the first quarter, EnerSys returned $159.1 million to shareholders, which included $150 million in stock buybacks and $9.1 million in dividends.

As for liquidity, EnerSys reported $346.7 million in cash, with a net leverage ratio of 1.6x, an increase from 1.1x last year, attributed to the Bren-Tronics acquisition and the buyback initiatives.

Looking ahead, EnerSys forecasts net sales for the second quarter between $870 million and $910 million, with adjusted earnings per share expected to range from $2.33 to $2.43. The company anticipates benefits from IRC 45X to be between $35 million and $40 million. Chief Financial Officer Andrea Funk indicated that the first quarter likely represented the lowest point for earnings this year, with improved policy clarity anticipated to stabilize market conditions.

While the full-year guidance remains on hold pending macroeconomic and policy developments, management is optimistic that adjusted operating earnings growth—excluding benefits from IRC 45X—will exceed revenue growth. This expectation is supported by operational efficiencies gained from the EnerGize framework and strong performance in the defense, communications, and data center sectors.

Investors and analysts will be watching closely as EnerSys navigates these changes and positions itself for future growth in a challenging economic landscape.