EchoStar has entered into a significant agreement with MDA Space to develop a new low Earth orbit (LEO) satellite constellation, valued at $1.3 billion. This partnership aims to establish a non-terrestrial network (NTN) for its direct-to-device (D2D) satellite services. Despite this promising development, analysts express concerns regarding the company’s long-term viability amidst ongoing financial uncertainty.

The contract encompasses the design, manufacturing, and testing of over 100 software-defined D2D satellites. Initial plans include a total of 200 satellites, with potential expansion to thousands to meet future demand. The first satellites are slated for delivery in 2028, with commercial services expected to commence the following year. EchoStar anticipates a total investment of $5 billion for this LEO constellation.

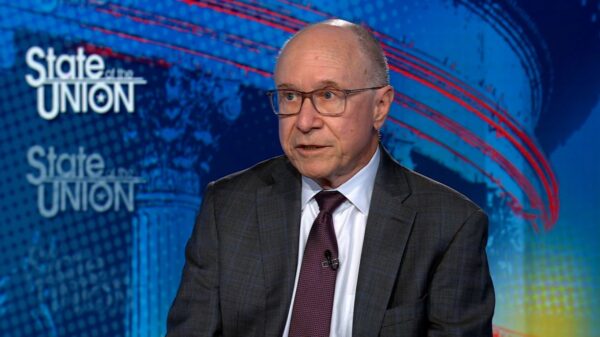

During the company’s Q2 earnings call for the period ending June 30, 2023, EchoStar’s CEO and President, Hamid Akhavan, emphasized that the LEO constellation will be self-funded. He stated the service aims to complement terrestrial offerings in areas with limited connectivity, potentially diminishing the need for new cell towers. “Our product will be indistinguishable from what you already have on your iPhone or your Android phone,” Akhavan noted, highlighting that the D2D service would enable voice, text, and video communications globally using standard 5G handheld devices.

While EchoStar’s service will be available to operators worldwide, Akhavan did not rule out the possibility of offering direct consumer access. Further details are expected to be announced at the upcoming World Space Business Week event in Paris.

However, the company faces significant challenges. EchoStar recently resumed bond payments, including interest on defaulted amounts, as it navigates complex financial discussions. In a filing with the US Securities and Exchange Commission on August 1, 2023, EchoStar acknowledged its precarious financial situation, stating, “substantial doubt exists about our ability to continue as a going concern.” The company is actively seeking additional capital and restructuring options, but it cautioned that success is not guaranteed.

Analyst Craig Moffett from MoffettNathanson has long predicted that EchoStar may be on a path to bankruptcy. He reiterated this viewpoint in a recent research note, indicating that the company is “still headed to liquidation, whether that’s in or out of bankruptcy.”

Federal oversight adds another layer of complexity. EchoStar is under scrutiny from the Federal Communications Commission (FCC) regarding its 5G network buildout and AWS-4 spectrum licenses, following challenges from SpaceX. Reports indicate that FCC Chair Brendan Carr is urging EchoStar to sell its AWS-4 band, which is critical for mobile satellite services. Carr has also been in discussions with EchoStar, seeking clarity on how the company plans to utilize its mobile satellite services.

Despite facing these pressures, EchoStar has been authorized to provide mobile satellite services over its AWS-4 spectrum, which supports its LEO constellation plans. Akhavan mentioned that the company is pausing its 5G network expansion until a resolution with the FCC is reached.

Financially, EchoStar reported adding 212,000 wireless subscribers in the second quarter, a notable increase compared to a loss of 16,000 a year earlier. The company concluded the quarter with 7.4 million subscribers and an improved churn rate of 2.69 percent. Wireless revenue increased by 4.7 percent to $935 million, but total revenue fell by 5.8 percent to $3.7 billion, resulting in a net loss of $306 million compared to a loss of $205 million in the previous year.

As EchoStar navigates these turbulent waters, the outcome of its financial strategies and the successful implementation of its satellite services will be closely watched by industry observers and stakeholders alike.