UPDATE: Windsurf’s sudden shift in ownership has sent shockwaves through Silicon Valley as the tech startup navigates a chaotic transition following the collapse of its anticipated $3 billion acquisition by OpenAI. Just last week, Google announced it would pay $2.4 billion to hire Windsurf’s top talent and license its intellectual property instead of acquiring the entire company.

The fallout from this deal has left Windsurf employees in turmoil, with many feeling abandoned and uncertain about their future. “This breaks the Silicon Valley social contract,” said Amjad Masad, CEO of competitor Replit. “Employees will hesitate to join startups if they fear being left behind.” As news of the deal spread, it became clear that the structure of such transactions might permanently alter the landscape for startup employees.

In a dramatic turn of events, discussions with OpenAI fell apart just before the deal was finalized, leading to a frenetic scramble for Windsurf’s survival. Ultimately, Cognition emerged as a last-minute buyer, acquiring what remains of Windsurf. “It was some of the most insane 72 hours I’ve seen in startup land,” remarked Maor Fridman, a general partner at F2.

Windsurf’s new CEO, Jeff Wang, took to social media to describe the bleak atmosphere within the company during the negotiations. “Some people were upset about financial outcomes or colleagues leaving, while others were worried about the future,” Wang shared. The exact terms of the Cognition deal remain undisclosed, but insiders estimate it to be significantly lower than the initial OpenAI offer, potentially around $300 million in stock.

Despite the turmoil, Cognition assured Windsurf employees that “100% of Windsurf employees will participate financially” in the deal, adding they will receive fully accelerated vesting for their contributions to date. However, many remain skeptical about the long-term implications of this unconventional arrangement.

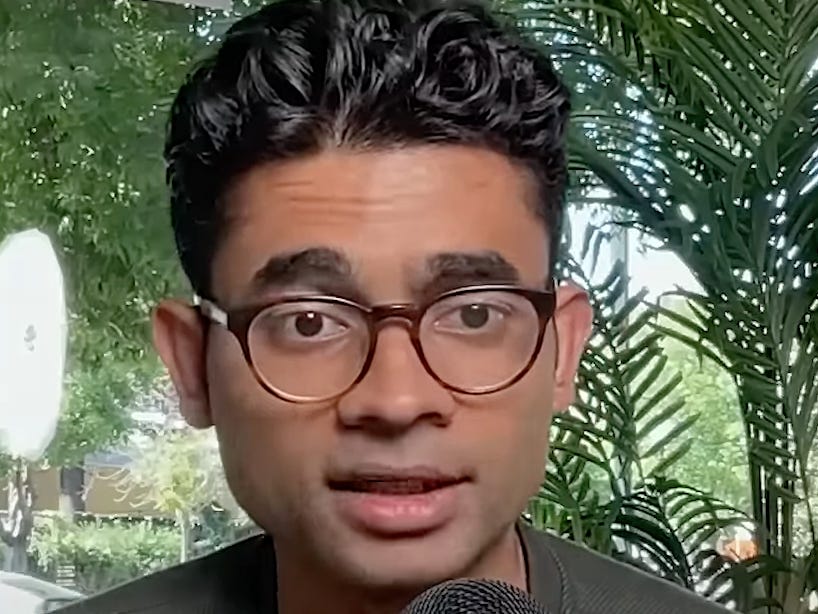

“It’s a pretty sad place to be,” said Deedy Das, an investor at Menlo Ventures. “When you join a company, you expect decisions to be made together, so this does have a chilling effect on founding team members.” This sentiment reflects a growing concern among venture capitalists that similar deals could jeopardize the morale and future of startup teams.

Industry leaders have voiced their frustrations publicly, with investor Vinod Khosla commenting, “Windsurf is a bad example of founders leaving their teams behind.” He emphasized the importance of ensuring that employees share in the success of the company they help build. “If an exit can happen and you don’t participate in it, that’s pretty bad for startup employees,” Masad added.

As the dust settles, the Windsurf fiasco raises critical questions about the future of startup equity and employee rights. “This isn’t a one-off; it’s part of a broader pattern where Big Tech hedges its bets,” noted Steve Brotman, managing partner at Alpha Partners. The recent trend of structured deals, like those seen with Character AI and Scale AI, highlights a shift away from traditional acquisitions.

For Windsurf employees, the road ahead remains uncertain. Many are contemplating their next steps, with some expressing interest in moving to more stable companies. Masad extended an olive branch, inviting Windsurf employees to consider opportunities at Replit, emphasizing that his company values employee contributions in acquisition scenarios.

The tech community watches closely as Windsurf’s situation unfolds, with implications for startup culture and employee expectations hanging in the balance. What happens next will likely shape how future deals are structured and how startups prioritize their teams amid rapid technological advancements.