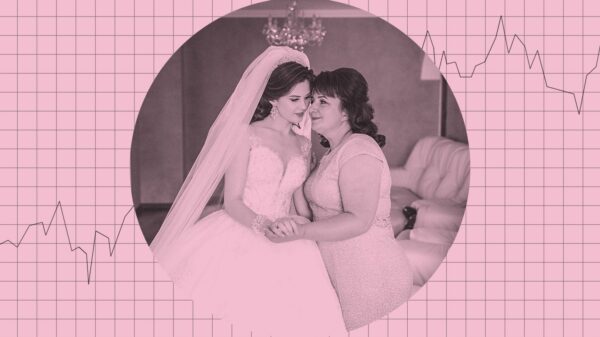

UPDATE: A family’s wedding budget dilemma is igniting heated discussions on fairness and financial planning. The parents of four daughters, who have saved over $100,000 for their weddings, are facing an urgent decision as the second daughter prepares for her upcoming nuptials.

In a recent column from Slate’s Pay Dirt, a mother revealed that she originally allocated $20,000 for her oldest daughter’s wedding, which took place 3.5 years ago. Thanks to the groom’s family connections, they managed to host a lavish celebration for just $12,000, leaving them with an unexpected surplus of $8,000. Now, as her second daughter plans to marry, the mother is grappling with the question of fairness in budgeting.

She proposed increasing the budget for her second daughter by an additional $10,000, bringing it to $30,000, to account for inflation and to ensure a comparable wedding experience. Her husband, however, argues that this would be unfair to the first daughter, sparking a divide in their approach to wedding finances.

Why This Matters NOW: This situation raises critical questions about equity and expectations in family financial planning. As inflation has surged by approximately 15 to 20 percent since the first wedding, the mother feels pressured to adjust the budget accordingly. Yet, her husband warns against creating a precedent where each daughter’s wedding budget must be equalized based on circumstances beyond their control.

In the column, financial expert Ilyce Glink advised against trying to equalize outcomes, emphasizing that the couple should provide each daughter with an equal amount adjusted for inflation. The suggested budget for the second daughter should be between $23,000 and $24,000, allowing her the freedom to spend wisely without unfairly inflating expectations.

The emotional stakes are high as the mother expresses her dread about the labor-intensive aspects of wedding planning, fearing the day will be filled with stress rather than joy. “You’re trying to fix daughter #2’s wedding economics by throwing money at it,” Glink wrote. “Instead, set clear boundaries about what you will and won’t do, give her a fair budget, and let her make her own choices.”

As families grapple with financial expectations, this story highlights the broader implications of money management, parental expectations, and the unique pressures surrounding wedding planning.

NEXT STEPS: Families and couples facing similar dilemmas can take note of this situation as a cautionary tale about wedding budgets. Clear communication and fair planning could help avoid conflicts in the future.

Expect ongoing discussions in financial advice circles as this story resonates with many navigating the complexities of family finances and expectations. Share your thoughts and experiences in the comments!