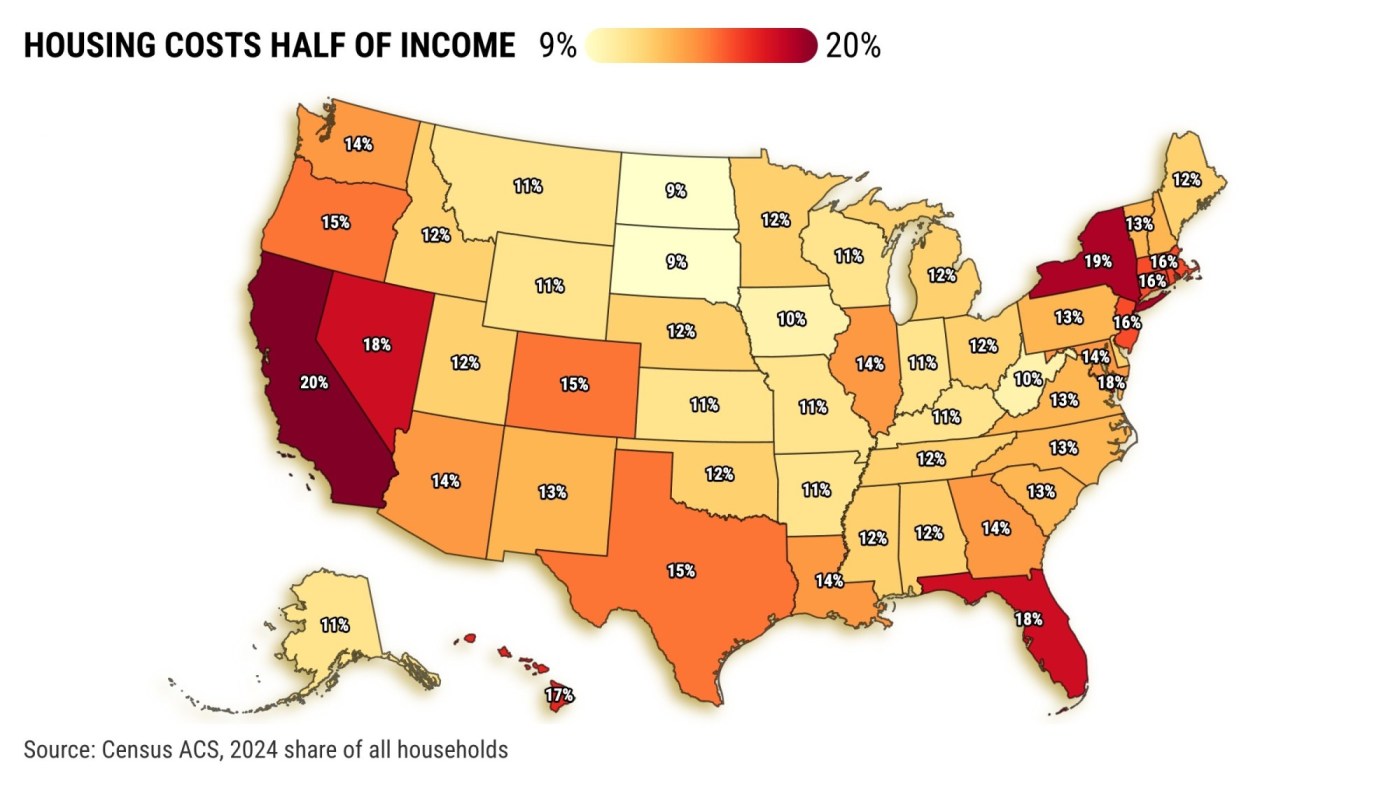

UPDATE: A staggering 1-in-5 California households are now spending over half of their income on housing expenses, according to alarming new data released from the 2024 Census Bureau. This urgent situation reveals that approximately 2.8 million households in the state are financially overwhelmed, making California the leading state in housing cost burdens.

The findings come as California grapples with skyrocketing rental and ownership costs, significantly affecting the well-being of its residents. Just 15 minutes ago, experts confirmed that California’s housing expenses are causing unprecedented stress among its citizens, highlighting an urgent need for intervention.

The data shows that California’s median rent has reached a staggering $2,104 per month, which is a shocking 60% higher than the national average of $1,319. This crisis is compounded by the fact that 56% of Californians are renters, with 1.6 million experiencing extreme financial duress.

In comparison, other states are feeling the impact as well, with Texas and Florida following, where 998,000 and 856,200 households respectively face similar burdens. Alarmingly, 27% of renters in California are under this financial strain, only slightly behind Florida’s 29%.

The economic landscape has shifted dramatically since the pandemic, with many Californians forced to pay more for larger living spaces. Rents in the state have surged by 30% since 2019, reflecting a national trend where rental costs have increased by 39%.

Homeowners are not spared either. About 15% of homeowners in California spend more than half their income on housing, the highest rate in the nation. The average monthly cost for a homeowner is now $2,280, significantly above the national average of $1,340.

As Californians continue to squeeze multiple occupants into homes to cope with these costs, the average rental unit houses 2.63 people, while homeowners average 2.92 occupants per residence. This overcrowding highlights the desperate measures families are taking to manage rising expenses.

Officials and housing experts are now calling for immediate action to address this growing crisis. As the state grapples with these challenges, the focus remains on potential solutions that could alleviate the financial burden on millions of residents.

As the situation develops, Californians are advised to stay informed about potential legislative changes and community support initiatives aimed at providing relief from this housing cost crisis. The urgency of the matter cannot be overstated—California’s housing affordability crisis is now at a breaking point.

For those affected, resources and support are critical as they navigate this challenging landscape. The ongoing discussions around housing policies will be pivotal in shaping the future of California’s housing market. Keep an eye on this developing story as it unfolds in the coming days.