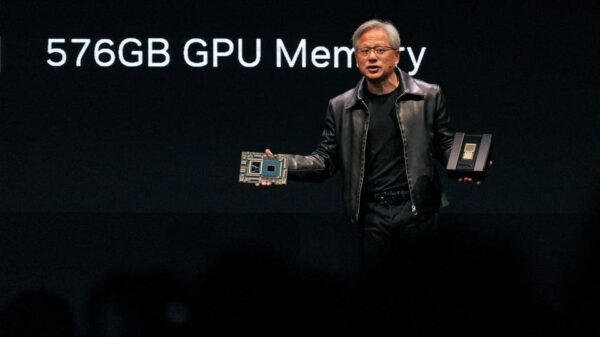

UPDATE: US stocks are holding steady as investors prepare for pivotal developments scheduled for tomorrow. The FOMC meeting, set to start on December 11, 2025, alongside earnings reports from major tech companies like Adobe (ADBE), Oracle (ORCL), and Broadcom (AVGO), are sending ripples through Wall Street today.

Market analysts emphasize the significance of these upcoming events. The FOMC’s decisions could lead to major shifts in monetary policy, directly impacting interest rates and economic outlooks. As of now, investors are closely monitoring any hints regarding rate changes that could influence market stability.

Why This Matters NOW: The anticipation surrounding the FOMC meeting and corporate earnings is palpable, with traders hoping for favorable outcomes in a turbulent economy. Tomorrow’s decisions are expected to shape investment strategies moving forward, making it a crucial time for market participants.

In the meantime, stocks are showing slight fluctuations as investors weigh their options ahead of these critical announcements. Analysts are reporting that the broader market remains cautious, with many waiting on the sidelines until more clarity is provided from the FOMC meeting and the tech earnings releases.

What to Watch For: As the FOMC convenes, market participants will be looking for indicators about future interest rate hikes. Additionally, the earnings reports from ADBE, ORCL, and AVGO could set the tone for the tech sector, influencing stock prices in the coming weeks.

Stay tuned for live updates and analysis as these events unfold. This is a moment of heightened urgency for investors and market watchers alike, with the potential for significant market movements based on tomorrow’s announcements.