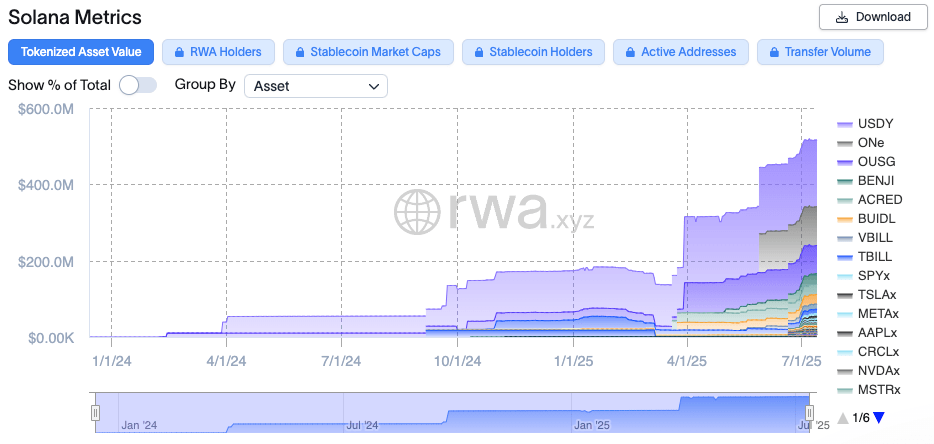

URGENT UPDATE: The growth of tokenized real-world assets (RWAs) on Solana is surging, dramatically outpacing Ethereum in 2025. Recent data from RWAxyz reveals a staggering 218% increase in Solana’s RWA value this year, reaching $553.8 million as of now, compared to Ethereum’s 81% rise to $7.7 billion.

This explosive growth in RWAs—a key sector in decentralized finance (DeFi)—is reshaping the landscape of digital assets. Overall, the total value of on-chain RWAs has skyrocketed by 196% since January 2024, climbing from $8.6 billion to a remarkable $25.5 billion today.

According to a report by Messari, Solana’s RWA market is now valued at $418.1 million, marking a 140.6% increase in 2025 alone. This growth is primarily fueled by yield-bearing assets, particularly tokenized treasuries like OUSG and USDY from Ondo Finance. These two assets collectively hold a valuation of $248 million, representing about 60% of Solana’s RWA market.

As a comparison, Solana’s RWA value has surged from just $173.8 million in January 2024. The gap with Ethereum is narrowing rapidly, and the implications for the DeFi ecosystem are significant.

Messari’s report indicates that most of the RWA value on both Ethereum and Solana—over 90%—is derived from stablecoins, according to RWAxyz data. The increasing adoption of RWAs is not just a trend; it signifies a major shift in how investors are looking at digital assets, prompting a reevaluation of market strategies across platforms.

The latest data underscores the competitive landscape of DeFi, with Solana now emerging as a formidable player. Investors and developers alike are closely watching this evolving market, as Solana’s innovative approach may redefine asset tokenization.

As we move further into 2025, stakeholders in the cryptocurrency space will need to keep a keen eye on these developments. The question remains: Can Solana maintain this momentum, or will Ethereum reclaim its leading position in the RWA market?

Keep following for the latest updates on this evolving story as it unfolds.