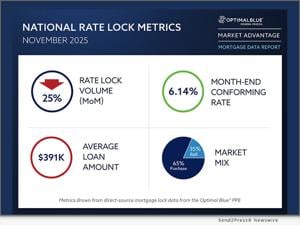

URGENT UPDATE: New reports from Optimal Blue reveal that mortgage lock volume for November 2023 has reached its highest level since 2021, defying seasonal trends and demonstrating a remarkable resilience in refinance demand. This surge is attributed to favorable mortgage rates, which continue to attract borrowers even as the housing market experiences typical seasonal slowdowns.

As of November 2023, refinance activity has surged, showcasing the enduring appeal of current interest rates. The latest data, released earlier today, indicates that the refinance market is thriving, with homeowners eager to capitalize on the lower rates available. This is a significant development for the real estate sector, which has been navigating various economic challenges throughout the year.

The report highlights that despite a typical decline in refinance applications during the fall months, the current interest rate environment has tempered these seasonal effects. Many homeowners are now seizing the opportunity to refinance their mortgages, leading to an uptick in lock volume that has not been seen since November 2021.

This surge in refinance demand is crucial, especially as economic conditions fluctuate. The data suggests that borrowers are motivated by the potential savings on monthly payments, which could amount to substantial financial relief for families and individuals. With the average mortgage rate hovering around 6.5%, many are looking to secure lower payments while they can.

The implications of this trend are significant. As refinance activity increases, it could provide much-needed support to the housing market during a period that is traditionally marked by reduced transaction volumes. Experts believe that this could also lead to an overall stabilization in home prices, which have been under pressure due to rising interest rates and economic uncertainty.

Looking ahead, the focus will be on how long this enhanced refinance demand can sustain itself. Market analysts are closely monitoring economic indicators, including inflation rates and Federal Reserve policies, which could influence future mortgage rates. Homeowners and potential borrowers are advised to stay informed about these developments, as they could impact their financial decisions in the coming months.

In summary, the latest data from Optimal Blue underscores a surprising resilience in the refinance market, offering a glimmer of hope for potential borrowers navigating a challenging economic landscape. As homeowners rush to take advantage of the current rates, the housing sector may see a revitalization that could alter its trajectory heading into 2024.

Stay tuned for more updates as this story develops, and consider sharing this news to inform others about the exciting changes in the mortgage landscape.