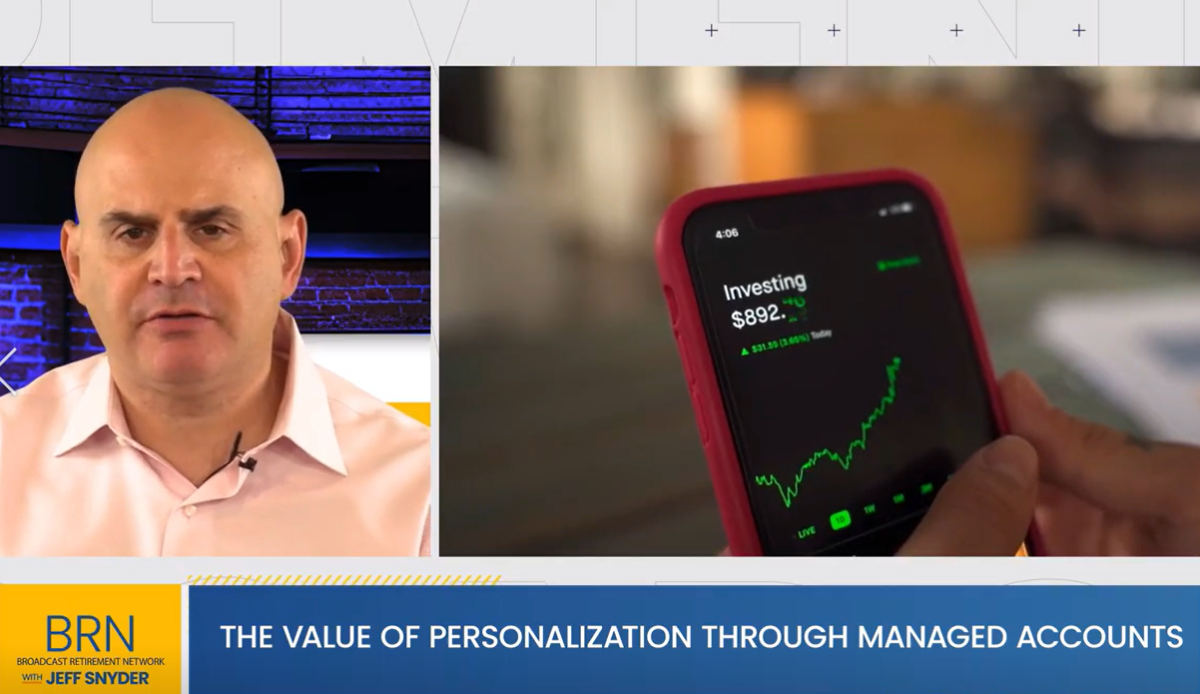

BREAKING: New insights reveal the rising importance of personalization in managed accounts, allowing tailored investment strategies to meet individual goals. During a live discussion on the Broadcast Retirement Network, Matthew Condos, Senior Vice President at Lincoln Financial, underscored how personalization is rapidly evolving in the retirement planning landscape.

As of this morning, Condos emphasized the urgency for employees to seek customized retirement plans that reflect their unique financial situations. He pointed out that a staggering 81% of employees are now interested in managed accounts, with over a quarter already engaging with these services. This data comes from a recent survey of 2,500 employees, showcasing a significant shift toward personalized investment solutions.

Managed accounts offer an innovative alternative to traditional investment vehicles like mutual funds. Unlike one-size-fits-all options, these accounts use personal data, including salary, savings rates, and even Social Security impacts, to build customized portfolios. This service is particularly valuable for those who might not have access to a financial advisor due to account balance limitations.

Condos explained that while target date funds were once the standard, providing minimal customization based solely on age, the evolution of managed accounts now allows for a more comprehensive approach. Participants benefit from ongoing portfolio management and can receive tailored recommendations that adapt to their changing circumstances.

During the discussion, Condos highlighted the role of plan advisors. They can facilitate access to managed accounts, which are gaining traction as default investment options in 401k, 403b, and 457 plans. The conversation underscored how these plans can help participants navigate complex investment landscapes, especially as they face significant life changes.

Moreover, research indicates that participants who opt for managed accounts are more engaged in their retirement planning. An impressive 72% of users reported increasing their savings rates, potentially leading to higher retirement income and greater financial confidence.

The need for managed accounts is underscored by evolving demographics and expectations for personalized services, similar to those experienced in other sectors, such as online shopping. Condos predicts that as technology advances, we can expect to see even broader integration of personalized financial tools in retirement plans.

With the growing interest in managed accounts, it’s crucial for employers to educate their workforce about these options. Effective communication ensures that employees understand the benefits and actively engage with their retirement strategies.

As the conversation around financial wellness continues to gain momentum, experts like Condos affirm that the future of retirement planning will increasingly focus on personalized services. This shift not only enhances individual outcomes but also empowers employees to take control of their financial futures.

Stay tuned for more updates on this developing story as personalized investment strategies reshape the retirement landscape.