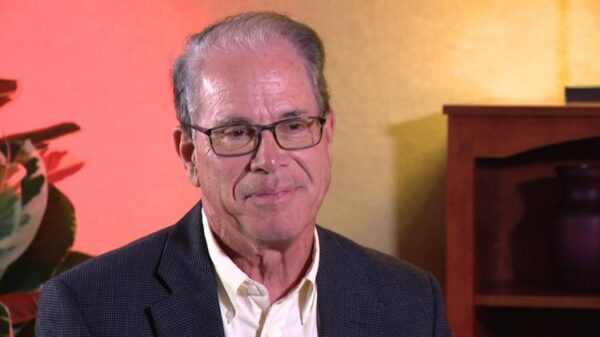

UPDATE: Oklahoma Attorney General Gentner Drummond is taking a bold stand against skyrocketing homeowners’ insurance rates, labeling them as “unacceptable.” In a powerful letter sent to Oklahoma Insurance Commissioner Glen Mulready on August 12, 2025, Drummond calls for urgent reform, insisting that the state’s high rates are not merely a result of weather-related risks, as Mulready claims.

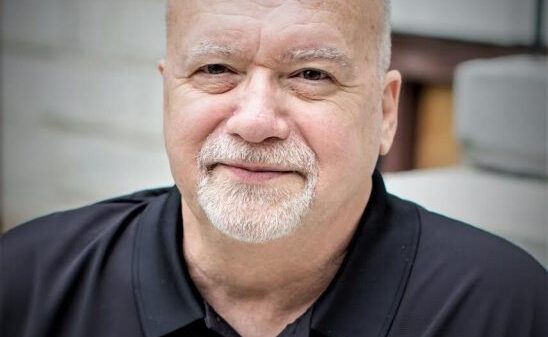

As of September 30, Mulready argued that severe weather events like tornadoes and wildfires are contributing factors to Oklahoma’s insurance costs. He emphasized that despite having around 100 insurance companies operating in the state, many are struggling to turn a profit. “On average, of those insurance companies, there are zero profits being made,” Mulready stated during discussions with lawmakers.

Drummond, however, firmly disputes this narrative, stating that Oklahoma’s tumultuous weather is being used as a “red herring” to obscure companies’ profit-making strategies. He argues that the state’s insurance market lacks true competition, claiming that insufficient enforcement of consumer protection laws has enabled companies to inflate prices without accountability.

“I want to assure you it’s not just an Oklahoma problem, it’s a national problem,” Mulready had told lawmakers last month, framing the crisis as part of a larger trend affecting homeowners across the United States.

The stakes are high as Oklahoma’s homeowners face some of the highest insurance costs in the nation. Drummond’s letter highlights the urgent need for reform, calling for action to lower these burdensome rates. He has urged Mulready to collaborate on a review of the insurance market, pushing for immediate changes that would benefit consumers.

In response, Mulready expressed his willingness to work together, emphasizing that Oklahoma’s homeowners’ market remains competitive by federal standards. He also pointed out initiatives like the Strengthen Oklahoma Homes program, launched this spring, which offers homeowners discounts averaging over $700 a year for fortifying their properties against severe weather.

As discussions continue, the upcoming legislative session could hold the key to significant changes. Mulready has pledged to introduce a new package of homeowners insurance-related legislation aimed at improving affordability, enhancing claim resolution, and implementing legal reforms to protect Oklahoma consumers.

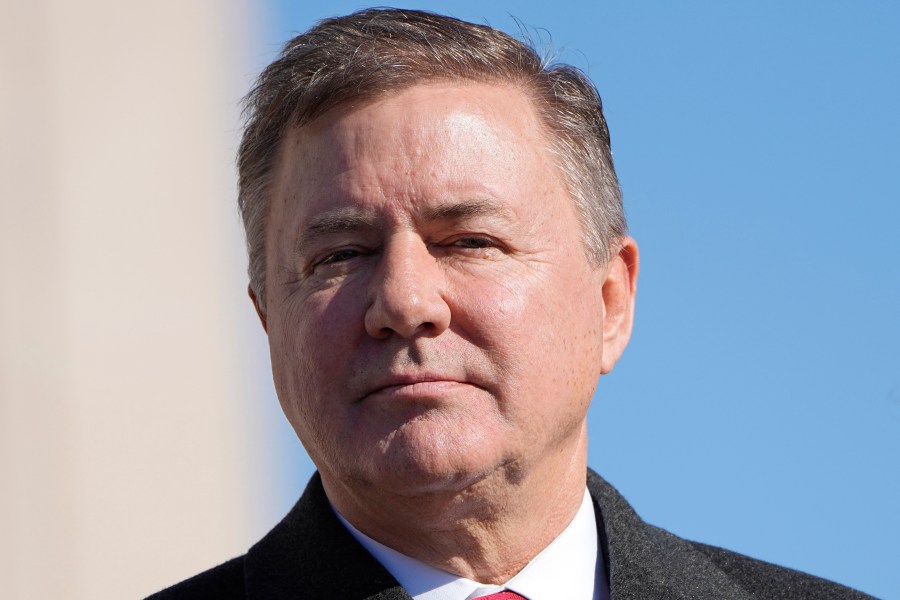

The situation remains fluid, and both officials are under pressure to address the growing discontent among homeowners facing financial strain from rising insurance costs. With the public eye on this issue, the urgency for action could not be clearer.

Next Steps: Homeowners and lawmakers alike are watching closely as developments unfold. Will Drummond’s push for reform lead to meaningful change? The answers may soon emerge as both officials prepare for ongoing discussions and potential legislative action. Stay tuned for more updates on this pressing issue.