URGENT UPDATE: Nvidia is experiencing significant turbulence as its shares plunged 11% this month amid growing competition from Google and fears of an AI bubble. Just weeks after hitting an all-time high, the chipmaker is now on the defensive, raising concerns among investors.

New reports confirm that Nvidia’s stock, once a darling of Wall Street, is facing mounting pressure. Following a blockbuster earnings report on November 19, CEO Jensen Huang expressed optimism about the company’s future. However, the optimism quickly faded as news broke that Google is pursuing a major chip deal with Meta, potentially threatening Nvidia’s market dominance.

Despite Huang’s reassurances about the strength of their AI business, Nvidia’s stock has been battered by speculation regarding an unsustainable market. SoftBank’s recent exit from its Nvidia position, selling $5.8 billion in shares to invest in OpenAI, has further fueled concerns about the company’s stability.

“There’s been a lot of talk about an AI bubble,” Huang stated during an earnings call, attempting to quell investor fears. Yet, the following day saw a sharp reversal in Nvidia’s stock performance as anxiety over tech valuations resurfaced.

After hitting a peak of $4 trillion in market cap, Nvidia is now viewed by some analysts as vulnerable. The emerging competition from Google, which is now reportedly working closely with Meta to provide advanced chips, raises alarms for Nvidia’s future prospects. The market is shifting quickly, and Nvidia may no longer be the sole star in the AI chip arena.

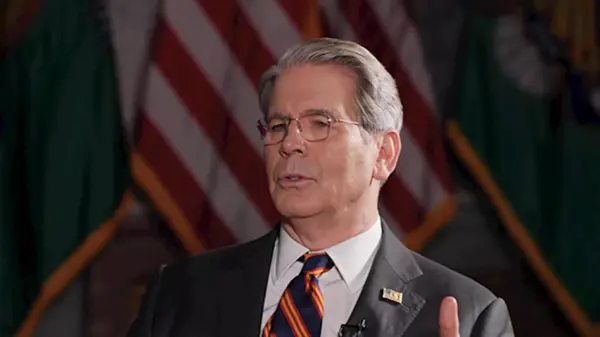

In a surprising twist, prominent investor Michael Burry, known for his role in “The Big Short,” has intensified his criticism of Nvidia. He questions the long-term viability of its chip technology and has likened the company to a modern-day Cisco caught in a bubble. Burry’s public skepticism is gaining traction, especially as he continues to hold put options against Nvidia.

“And once again there is a Cisco at the center of it all,” Burry wrote on his Substack, signaling a bearish outlook on Nvidia.

Nvidia has not taken Burry’s comments lightly. The company released a memo to analysts countering his claims, stating that his calculations were “incorrect” and emphasizing that their strategic investments form only a small portion of revenue. Despite the pushback, Burry described Nvidia’s response as “disappointing,” further complicating investor sentiment.

As the month closes, Nvidia is still the world’s most valuable company by market cap, showing some signs of recovery with shares rising 1.37% on Wednesday. Major tech firms are still heavily investing in Nvidia’s cutting-edge chips, with CFO Colette Kress projecting $500 billion in AI chip orders for the 2025-2026 period.

While the AI landscape continues to evolve, and competition intensifies, Huang remains steadfast. “Nvidia is unlike any other accelerator,” he reassured during the earnings call. “We excel at every phase of AI, from pre-training and post-training to inference.”

This month’s developments serve as a stark reminder that even industry leaders like Nvidia must navigate a rapidly changing market. Investors and tech enthusiasts alike will be watching closely to see how this situation unfolds and what it means for the future of AI technology.