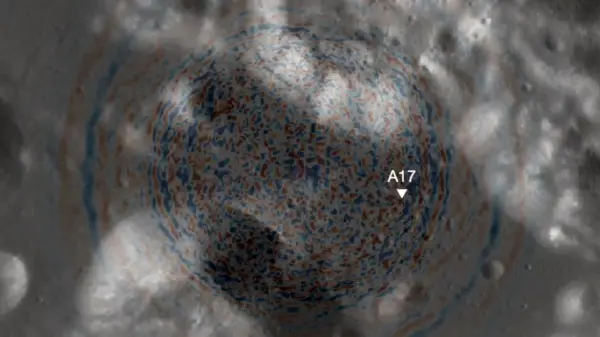

URGENT UPDATE: Homeowner’s insurance is becoming increasingly challenging to navigate as rising costs and strict requirements impact millions of homeowners across the United States. This developing crisis comes in the wake of devastating natural disasters in regions like California, North Carolina, and Florida, making it crucial for homeowners to understand how to secure adequate coverage.

During a recent discussion on the Broadcast Retirement Network, insurance expert Michael O’Connor of AssuredPartners highlighted the pressing need for homeowners to reassess their insurance policies, especially as many are facing significant price hikes—some as high as 100% or 200%. Homeowners need to be proactive and informed, particularly if they have a mortgage, which requires a certain level of homeowner’s insurance.

The conversation emphasized that while natural disasters have become more frequent, the insurance market is tightening. O’Connor stated, “Carriers are still writing business, but it is harder and more restrictive.” Homeowners will need to provide more information to obtain the best rates, including documentation such as wind mitigation and elevation certificates, especially in high-risk areas like Florida.

Many homeowners may not realize that standard homeowner’s insurance policies usually exclude coverage for natural disasters such as floods and earthquakes. As O’Connor pointed out, “All homeowner’s policies are going to exclude flood and earthquake.” This lack of coverage could leave homeowners vulnerable in the event of a disaster.

The discussion also touched on the emotional toll of recent events, as families in California and other affected areas grapple with the loss of their homes. O’Connor stressed the importance of insurance as a critical component of risk management, stating, “If something terrible does happen, you do have some recourse to recover from that.”

As homeowners face these challenges, the need for expert guidance has never been more critical. O’Connor urged consumers to understand their policies and to seek assistance from independent agents who can help navigate the confusing landscape of homeowner’s insurance. He noted, “It’s not always transparent,” and warned that policies marketed solely on price often provide inadequate coverage.

With costs rising and new requirements being implemented, homeowners are encouraged to review their insurance policies at least annually. As O’Connor advised, “If you’re getting a 20% increase, that’s a sign to explore other options.”

The implications of inadequate insurance coverage can be severe, leaving homeowners in financial jeopardy when they need help the most. As the insurance market continues to evolve, staying informed and proactive is essential for homeowners looking to protect their most significant asset.

As we move further into 2023, homeowners should prioritize understanding their insurance needs and seek professional advice to ensure they are adequately covered against the unpredictable nature of climate change and its associated risks.

Stay tuned for further updates on this pressing issue, and do not hesitate to consult an insurance expert to fortify your home against potential financial losses.