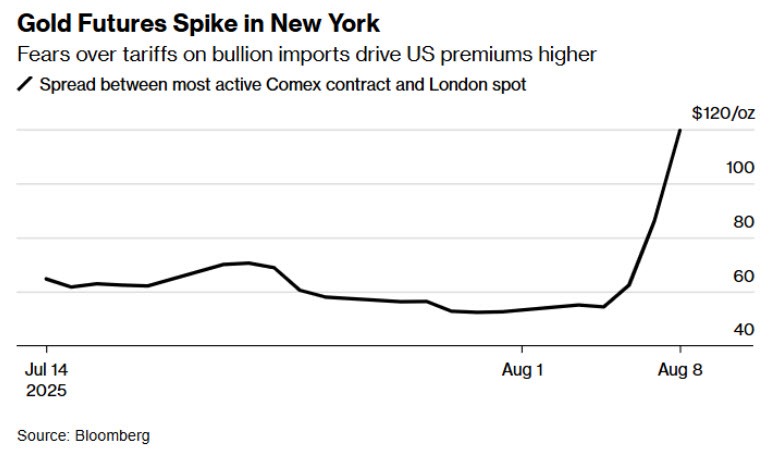

URGENT UPDATE: Gold prices remain steady at $3,392 per ounce despite a surprising surge in COMEX futures following new tariffs that caught the market off guard. This unexpected announcement is leading to significant price discrepancies between U.S. and overseas gold markets, raising questions about the future of gold trading.

The Trump administration has introduced tariffs that effectively make gold more expensive in the U.S., creating an unusual situation where COMEX prices differ sharply from those in London. Experts are closely monitoring this developing situation as traders assess the implications of these tariffs on supply chains.

As it stands, gold must be refined in Switzerland—which processes approximately 90% of gold from industrial mines—before it can be transported to the U.S. for delivery. This additional layer, combined with the new tariffs, complicates the logistics and costs of importing gold, causing immediate ripples in the market.

Recent reports from UBS suggest that the market was unprepared for this tariff announcement. The once booming gold rush seen earlier in the year has now cooled, leaving traders concerned about potential funding stresses. The 1-month forward gold lease rates remain low at -0.18%, a stark contrast to the surge seen at the beginning of the year when rates hit 5%. This suggests a sufficient supply of gold in London for now, but concerns linger about future availability.

Market reactions indicate that traders are taking a cautious approach, with no major alarms raised just yet. However, clarity is desperately needed from the U.S. Customs Border Protection agency regarding the motivations behind these tariffs. Are they a mere technical oversight, or a strategic move to bolster U.S. Treasury reserves?

Analysts speculate that if the tariffs remain, they could lead to a dramatic increase in gold prices as demand spikes due to constrained supply. The potential for a “gold benchmark” that enhances the U.S. position in the global market looms large, possibly setting the stage for explosive price movements.

As this situation unfolds, the implications of the tariffs could reshape the gold market, leading to a reevaluation of strategies among traders and investors. The global community watches closely, as the outcome will not only impact prices but could also shift the dynamics of the precious metals market for the foreseeable future.

Stay tuned for updates as this story develops.