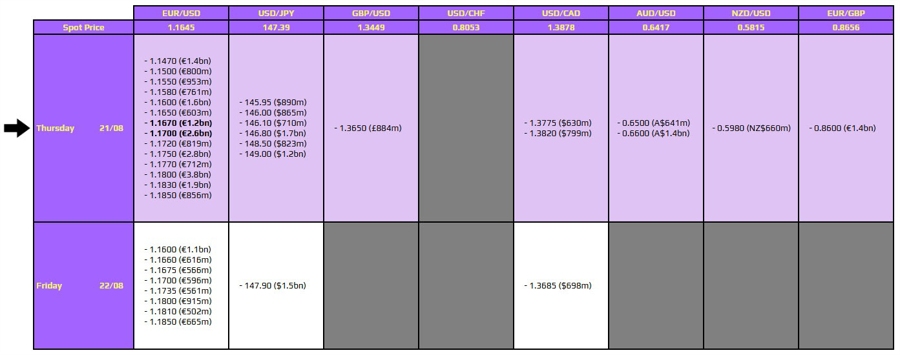

URGENT UPDATE: FX option expiries are set to impact trading today at 10 AM New York time with key levels for the EUR/USD currency pair. Notably, expiries at 1.1670 and 1.1700 could significantly influence market movements as traders brace for critical economic data.

The 1.1670 level aligns closely with crucial hourly moving averages currently hovering around 1.1664-68, potentially limiting any upward pressure during the trading session. Meanwhile, the 1.1700 level adds further resistance, keeping a lid on price extensions ahead of the US trading hours.

Investors should remain vigilant as French and German PMI data are scheduled for release today, marking key risk events for the euro. Simultaneously, the dollar is in a state of flux as it digests recent Federal Reserve headlines in anticipation of the Jackson Hole Economic Symposium tomorrow.

The financial community is closely monitoring these developments to gauge their impact on market sentiment. The results of today’s PMI data could serve as a catalyst for volatility, especially with the looming Fed discussions.

Traders, analysts, and investors are advised to stay informed as these expiries and economic indicators unfold. For ongoing updates and in-depth analysis, visit investingLive (formerly ForexLive) to keep abreast of the latest market insights.

As the clock ticks down to the 10 AM cut, the urgency to adapt to these market dynamics is palpable. Share this information and stay ahead in the rapidly evolving FX landscape.