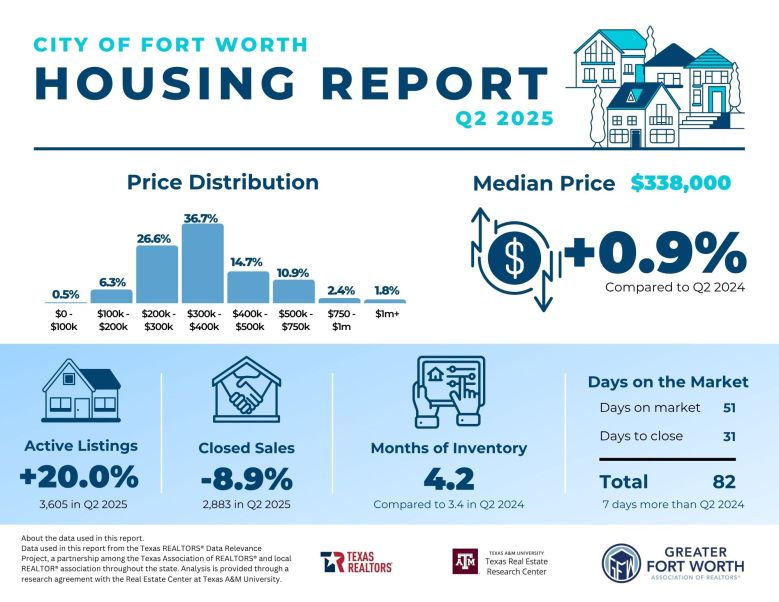

UPDATE: Fort Worth homebuyers are encountering a highly competitive market as new inventory emerges, but prices remain a concern. Despite recent price reductions on homes, local experts warn that the market is not yet fully tilted in favor of buyers.

Paul Epperley, president of the Greater Fort Worth Association of Realtors, stated that while there are signs of stabilization, including homes with “price reduced” tags, he cautions buyers not to expect drastic changes. “There is a curve in the road right now… I wouldn’t say that it’s flipped in favor of the buyer,” Epperley emphasized.

As of July 20, 2025, Fort Worth recorded a total of 1,001 home sales with just over 4.2 months of inventory, indicating a continued seller’s market. In comparison, neighboring Dallas has 5.4 months of inventory, which further tightens the Fort Worth housing landscape.

Epperley highlighted the challenges faced by younger Realtors who have only experienced a seller’s market. “A lot of our Realtors haven’t lived through a buyer’s market… They haven’t fine-tuned that tool yet for competitive pricing,” he noted. This shift presents a “teaching moment” for many in the industry.

The shift towards a more balanced market is welcomed by many homebuyers. “This will allow home buyers to take their time while searching for homes during the summer season,” Epperley explained. However, the competitive pricing remains a significant factor as Tarrant County leads in sales volume with 2,043 homes sold, despite a 2.3% year-over-year sales decline.

Meanwhile, current mortgage rates are proving to be a hurdle for many prospective buyers, with the average 30-year rate sitting at 6.796%. Experts forecast a gradual decrease in rates through early 2026, but a return to the 3% mortgage rates of previous years is unlikely. Steve Cotton, president of Cotton Wealth Management Associates, stated, “Six to seven percent mortgage rates are proving to be a little bit of a disincentive for buyers.”

The demand for housing continues to rise, yet inventory remains insufficient to meet this demand. The National Association of Home Builders reports that Dallas and Fort Worth rank No. 3 in new units per 1,000 homes, but the number of housing units approved in 2024 fell by 7.9% compared to 2022.

In a further complication, Cotton pointed out that the recent 50% tariff on copper imports announced on July 8 could lead to increased construction costs. This tariff could impact new home prices and further strain the already low inventory in the area.

As buyers navigate this complex landscape, Epperley advises exploring options outside of Tarrant County, where markets are more balanced. “You’ve got to let your buyers know about those options,” he said, stressing the importance of market-savvy Realtors who can guide clients through local intricacies.

With inventory levels still low and competition high, the Fort Worth housing market remains a challenging environment for homebuyers. As the summer season progresses, potential buyers will need to stay informed and ready to act quickly in this evolving landscape.

Stay tuned for updates as we continue to monitor the Fort Worth real estate market and its impact on buyers and sellers alike.