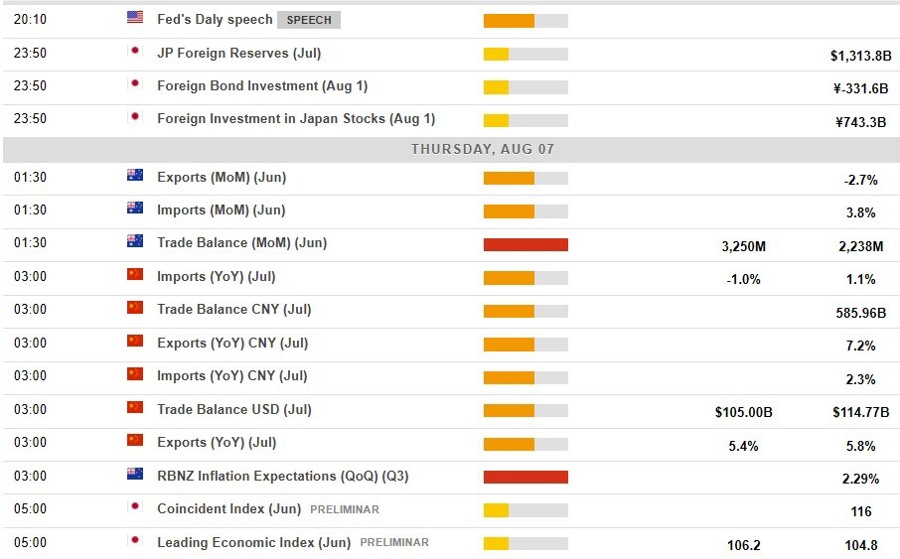

UPDATE: In a critical economic update, Mary Daly, President of the Federal Reserve Bank of San Francisco, is scheduled to speak today, August 7, 2025, at 10:30 AM GMT. Her recent remarks indicate a significant shift toward a more dovish stance, suggesting that two rate cuts may be appropriate this year.

This is a developing story that could impact financial markets globally as investors closely monitor Daly’s insights. Earlier this week, Daly’s comments hinted at a growing openness to rate cuts, making her one of the key voices of the Federal Reserve under Chair Jerome Powell. Her statements carry weight, given her position and influence within the Fed.

Market analysts are particularly focused on Daly’s discussion of economic indicators and how they will shape future monetary policy. The Australian trade balance data is being watched, though it is not expected to hold the same significance as in the past.

More crucially, attention is on the Reserve Bank of New Zealand (RBNZ) as it prepares to release inflation expectations data. As the RBNZ approaches its scheduled rate decision on August 20, a rate cut seems increasingly likely, following recent labor market data that reinforces this expectation.

“The current labor market dynamics in New Zealand support the case for a rate cut,” said an economic analyst familiar with the situation. “All eyes will be on the upcoming RBNZ meeting.”

As the economic landscape shifts, these developments are crucial for investors and policymakers alike. The outcomes of these discussions could have far-reaching implications for markets and economies around the world.

Stay tuned for updates as this story unfolds and as more economic data is released throughout the day. The implications of Daly’s remarks and the upcoming RBNZ decisions are set to be pivotal in shaping monetary policy and market responses in the coming months.