UPDATE: The Federal Reserve is poised to announce its first rate cut of the year during its meeting on September 11, 2025. As concerns mount over a slowing economy and a weakening job market, this potential move could provide much-needed relief for millions of Americans grappling with high borrowing costs, particularly in the housing market.

The Fed has held interest rates steady at 4.25-4.5 percent since December 2024. However, recent economic data has prompted speculation that officials will cut the benchmark rate by 0.25 percent at this week’s meeting. This rate is crucial as it influences the rates banks charge each other and, by extension, the mortgage rates consumers pay.

According to Bankrate Financial Analyst Stephen Kates, “The upcoming Federal Reserve Open Market Committee’s meeting might be one of the most anticipated in years.” He highlights the intense scrutiny faced by the Fed amid rising inflation and a faltering labor market. A rate cut, while expected, might not come without controversy, as debates among governors intensify, particularly with President Donald Trump exerting pressure on the Fed.

What does this mean for homebuyers? Mortgage rates, which surged in 2022 due to the Fed’s aggressive rate hikes, have hovered between 6 percent and 7 percent. However, as optimism grows that the Fed will lower rates, average mortgage rates have begun to decline. As of September 11, the average 30-year fixed-rate mortgage dipped to 6.35 percent, according to data from Freddie Mac.

Experts caution, though, that while a rate cut may boost consumer confidence, the immediate impact on mortgage rates may already be priced in. Kates notes, “For prospective homebuyers, much of the impact on mortgage rates has already occurred through anticipation alone.”

The implications of a rate cut extend beyond homebuyers. Lower rates could alleviate financial strain for many borrowers, including recent graduates and individuals looking to refinance debt. Kates emphasizes that easing borrowing costs could open doors for refinancing opportunities, which would benefit households struggling with high-interest debts.

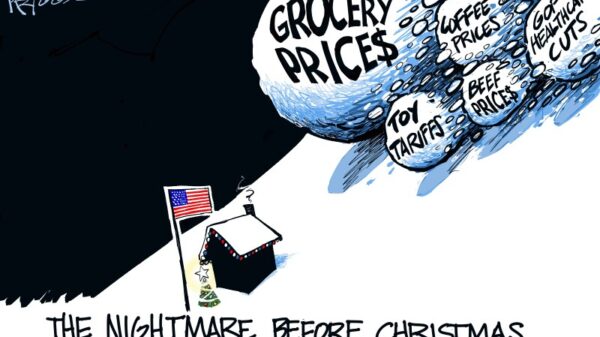

However, potential downsides loom. Experts warn that a rate cut could exacerbate inflation, affecting savers and those on tight budgets. “Falling interest rates will begin to erode the attractive yields currently available on savings products,” Kates stated. Furthermore, if the Fed’s decision does not align with market expectations, it could lead to increased volatility, causing mortgage rates to spike again.

The U.S. economy finds itself at a critical juncture, balancing between a cooling labor market and persistent inflation. Investors and consumers alike are advised to remain vigilant as the Fed’s decision could reshape financial landscapes in the coming weeks.

As the Federal Reserve prepares to make this crucial announcement, many are watching closely to see how the rate cut will impact their financial futures. Stay tuned for updates and insights following the Fed’s decision later this week.