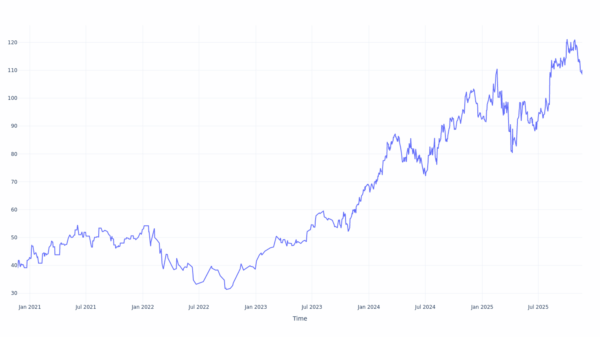

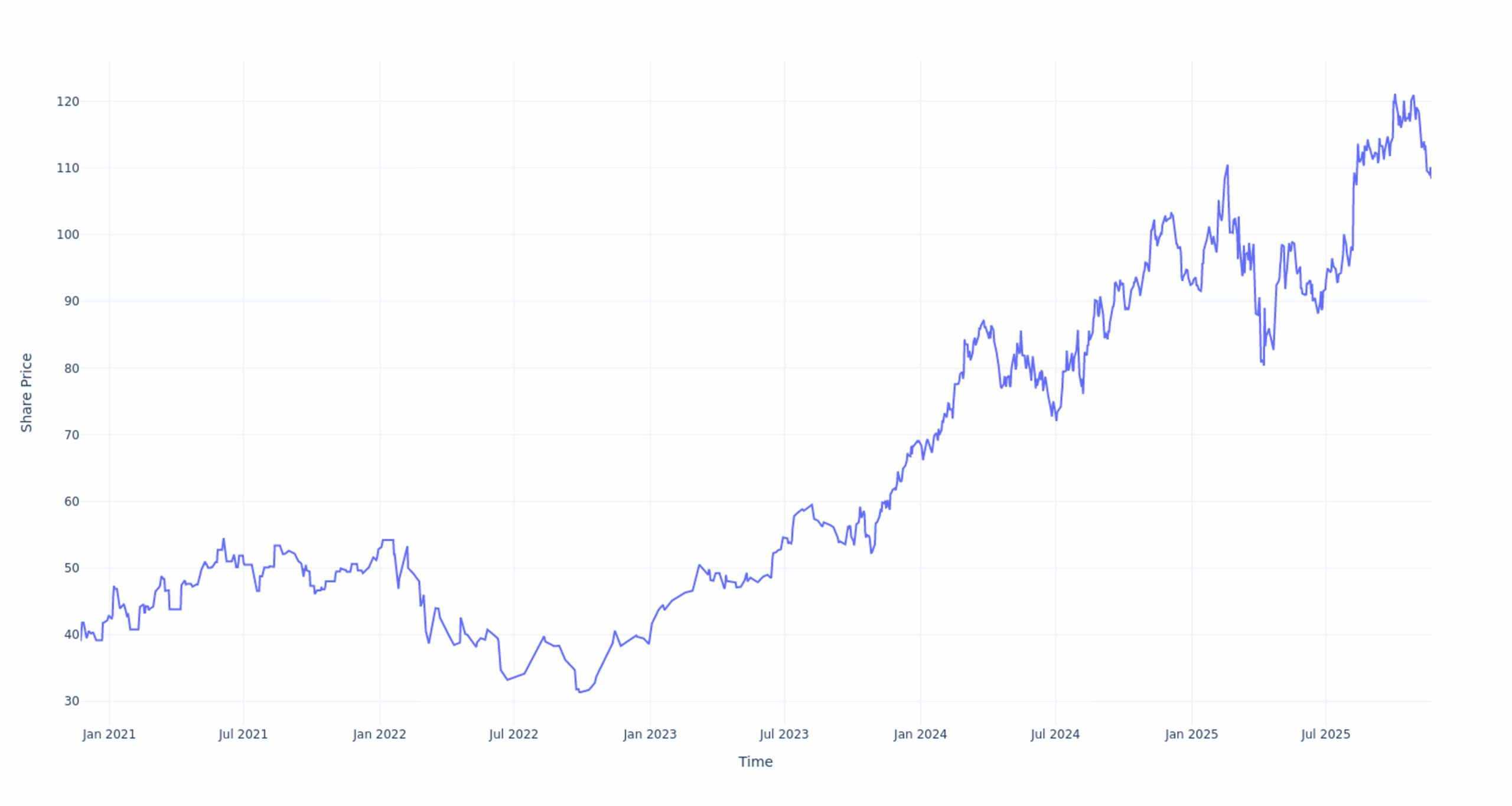

BREAKING: CRH (NYSE:CRH) has just announced impressive financial results, revealing a staggering 177% return on investment over the past 5 years. This surge outperformed the market by 8.76% annually, showcasing an average annual return of 21.19%.

This remarkable performance means that if an investor had purchased $100 of CRH stock five years ago, it would now be valued at $277.69, reflecting a significant growth in wealth amidst fluctuating market conditions.

Currently, CRH boasts a market capitalization of $72.57 billion, underscoring its strong position in the industry. The company’s ability to deliver compounded returns highlights the crucial impact of long-term investments on financial growth.

What does this mean for investors today? With CRH’s stock price currently at $108.37, the outlook remains positive. Investors looking for potentially lucrative opportunities may want to consider CRH’s upward trajectory as part of their portfolio strategy.

In a time when market volatility is prevalent, CRH’s steady performance serves as a beacon for investors seeking stability and growth. The company’s success is not just a reflection of its operational efficiency but also of strategic decisions that have bolstered its financial health.

As the market continues to evolve, investors should keep a close eye on CRH and its upcoming quarterly results, which could further influence stock performance. The next earnings report is anticipated soon, and analysts are eager to see if CRH can maintain this impressive momentum.

Overall, CRH’s journey over the past five years underscores the significance of compounded returns and the potential for substantial gains in the stock market. Investors are encouraged to stay informed and consider the implications of these developments for their financial strategies.

Stay tuned for further updates as this story develops.