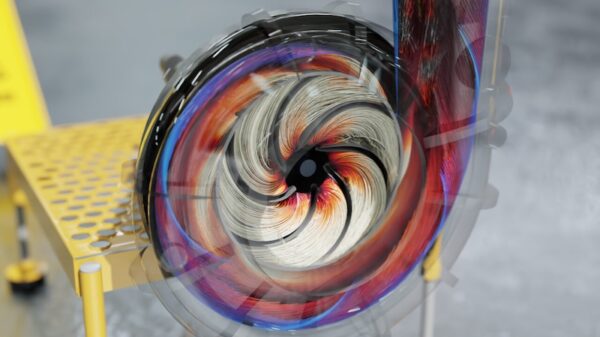

UPDATE: In a groundbreaking announcement today, October 13, Broadcom (AVGO) and OpenAI have forged a significant partnership to deliver custom AI accelerators and Ethernet networking chips aimed at supporting an impressive 10 gigawatts of data center capacity. This deal, which is set to roll out in the second half of 2026 and extend through 2029, marks a critical moment in the rapidly evolving generative AI landscape.

Broadcom’s stock surged by 10% intraday following the announcement, reflecting investor confidence in the company’s ability to capitalize on the escalating demand for AI infrastructure. This partnership not only surpasses Advanced Micro Devices (AMD)‘s recent agreement with OpenAI for 6 gigawatts of capacity but also signifies Broadcom’s emergence as a formidable competitor to Nvidia (NVDA) in the accelerated computing sector.

Why does this matter right now? The immense potential of generative artificial intelligence is driving major investments into the necessary infrastructure. Broadcom’s collaboration with OpenAI, one of the leading developers of AI models, expands its customer base and positions the company for rapid growth over the next five years.

This partnership marks OpenAI as Broadcom’s fifth custom accelerator customer, following a recently unnamed fourth customer revealed in September. Experts predict that these partnerships will trigger a substantial revenue increase by 2026 and 2027, on top of existing revenue streams.

“We have raised our fair value estimate for Broadcom to $365 per share from $325 due to this transformative deal,” stated a Morningstar analyst. “We expect AI revenue to double to $40 billion in fiscal 2026 and nearly double again in 2027.”

Broadcom had previously anticipated generating $10 billion in new revenue in fiscal 2026 from its fourth customer, but this new agreement suggests an even stronger growth trajectory. As existing customers increase their orders for custom compute and networking chips, and new clients join the fold, Broadcom is poised for a long-term growth runway in the AI sector.

The implications of this partnership extend beyond mere numbers; it represents a vital evolution in the tech industry, as companies race to refine their AI capabilities. Investors and tech enthusiasts alike are closely watching how Broadcom leverages this opportunity in the coming years.

Stay tuned for more updates on this developing story, as Broadcom’s advancements in AI technology could reshape the competitive landscape in the tech sector.