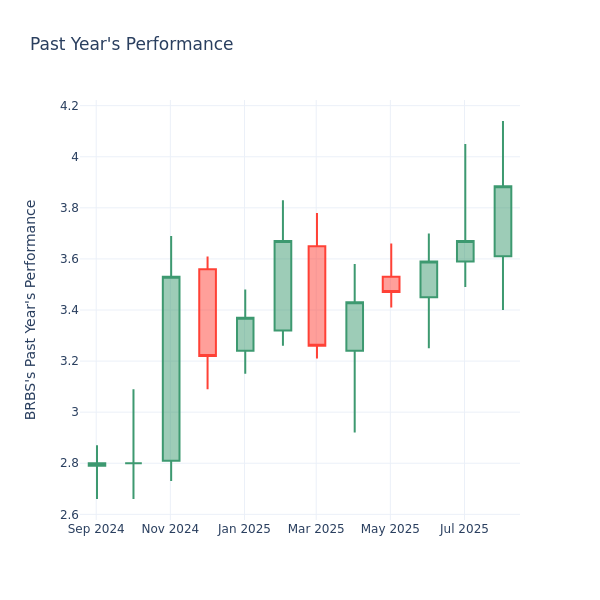

URGENT UPDATE: Blue Ridge Bankshares Inc. (BRBS) is facing a significant downturn today, with its stock price dropping by 3.60% to $3.88. This decline raises immediate concerns for investors who have seen a monthly increase of 6.15% and an impressive annual surge of 38.75%.

Investors are now questioning whether the stock is overvalued, especially given its current performance. The P/E ratio, a critical metric for evaluating stock potential, shows Blue Ridge Bankshares at 11.29, notably lower than the industry average of 15.12. This discrepancy could indicate that the market expects poorer future performance from Blue Ridge compared to its peers, or it may suggest that the stock is undervalued.

As market analysts review the implications of this P/E ratio, many are concerned that a lower valuation could signal stagnation or a lack of growth potential. The P/E ratio is a vital tool for investors, allowing them to assess a company’s market performance relative to historical earnings and industry benchmarks.

Blue Ridge Bankshares’ current struggles are particularly troubling for shareholders eager for robust returns. The recent drop in stock price is a stark reminder of the volatility present in the banking sector. Investors are advised to consider the broader context, including industry trends and economic cycles, when interpreting the P/E ratio.

As the situation develops, market watchers should remain alert for any updates from Blue Ridge Bankshares and look for potential movements in stock performance. Analysts recommend using the P/E ratio in conjunction with other financial metrics to form a comprehensive view of the company’s viability.

For real-time updates and deeper insights into stock performance, Benzinga provides crucial metrics that can guide investors in making informed decisions.