UPDATE: The federal government is preparing to intervene in the housing market to prevent a potential crash, signaling a major shift in strategy just as affordability reaches critical lows for homebuyers. As housing prices show signs of resilience, experts predict a series of bailouts will be implemented throughout this year to stabilize the market.

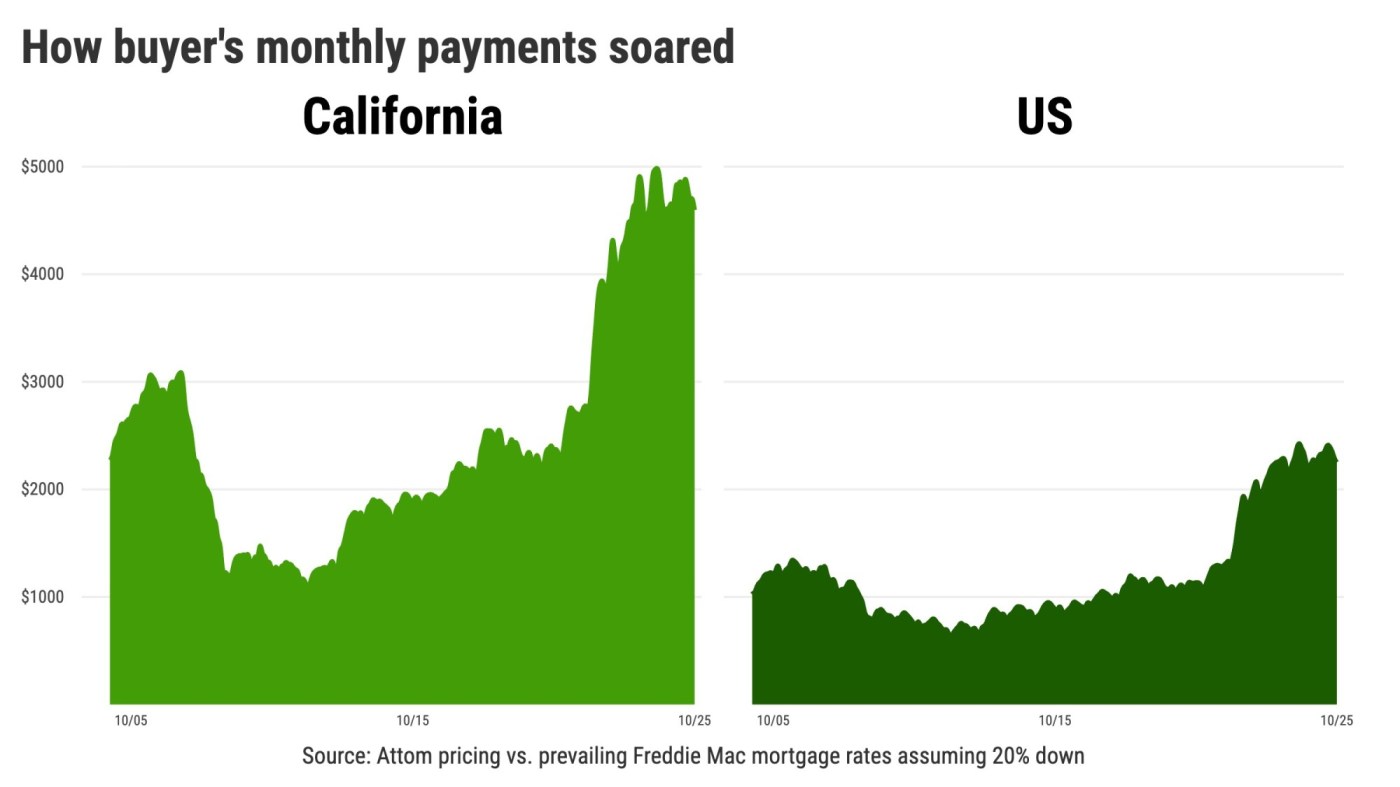

Latest reports highlight that the median monthly payment for a home in the United States surged to $2,251 in October for a median-priced home valued at $360,000. While this represents only a 2% increase over the past year, the burden on buyers has skyrocketed an astonishing 99% over the last five years and 198% since 2010. In California, the median monthly payment hit $4,597 for a home priced at $735,000, remaining flat year-over-year but up 267% since 2010.

With the ongoing economic strain, various government initiatives are set to bolster the housing market. These include:

– **New Loan Options:** A proposal for a 50-year mortgage is being floated to provide an extended repayment option for buyers.

– **Lower Mortgage Rates:** Federal mortgage agencies are modifying their strategies to hold certain loans, effectively reducing the rates.

– **Financial Incentives:** The government is expected to introduce cash inducements, particularly targeting first-time homebuyers, to stimulate demand.

– **Tax Breaks:** Enhancements to existing tax benefits for home sellers could encourage more sales, particularly benefiting older homeowners looking to downsize.

– **Increased Investment Appeal:** Recent tax law changes have made real estate more attractive to investors, creating additional competition for individual buyers.

While these measures are anticipated to temporarily boost sales, they risk distorting an already unbalanced market. Following the last federal intervention, home sales plummeted by 26% nationally and 31% in California as mortgage rates began to climb from historic lows.

As the government gears up for these interventions, the implications are significant for the housing landscape. Homebuyers and industry professionals await the outcome of these policies, with many questioning whether government support will truly address the underlying issues of housing affordability and market stability.

What’s Next? The housing market will continue to be closely monitored as these bailouts roll out. Key indicators will include fluctuations in sales figures, buyer sentiment, and the overall impact of these government initiatives on market stability and affordability.

Stay tuned for further updates as this developing story unfolds, impacting countless Americans navigating the current housing crisis.