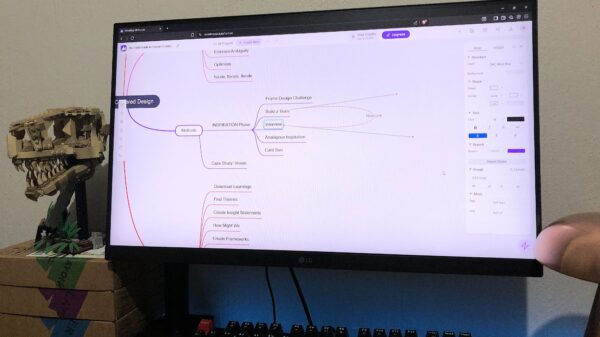

TikTok has implemented a new advertising policy requiring merchants to use its AI-powered tool, GMV Max, for the TikTok Shop, leading to significant backlash from sellers. Effective from September 2025, this mandate automates targeting, bidding, and ad placements while restricting links to external websites, compelling merchants to direct traffic exclusively to TikTok Shop listings. The change is part of an effort to enhance TikTok’s e-commerce capabilities amid ongoing regulatory scrutiny and a potential sale of its U.S. operations.

Concerns over the new policy have emerged as merchants express frustration about the restrictions on linking to their own online stores. Many sellers argue that this limits their marketing flexibility and could negatively impact their sales. TikTok Shop has reported impressive growth, with U.S. sales exceeding $10 billion in its second year. However, the new requirements may pose challenges for smaller merchants who could struggle with increased advertising costs without the benefit of diversifying their sales channels.

Merchant Reactions and Industry Insights

Interviews with industry insiders reveal a growing discontent among merchants. One e-commerce executive, who spoke anonymously to Business Insider, criticized the mandate as a “heavy-handed” approach that diminishes control over marketing strategies. Brands previously using TikTok ads to drive traffic to platforms like Shopify now face heightened expenses without the ability to leverage multiple sales avenues.

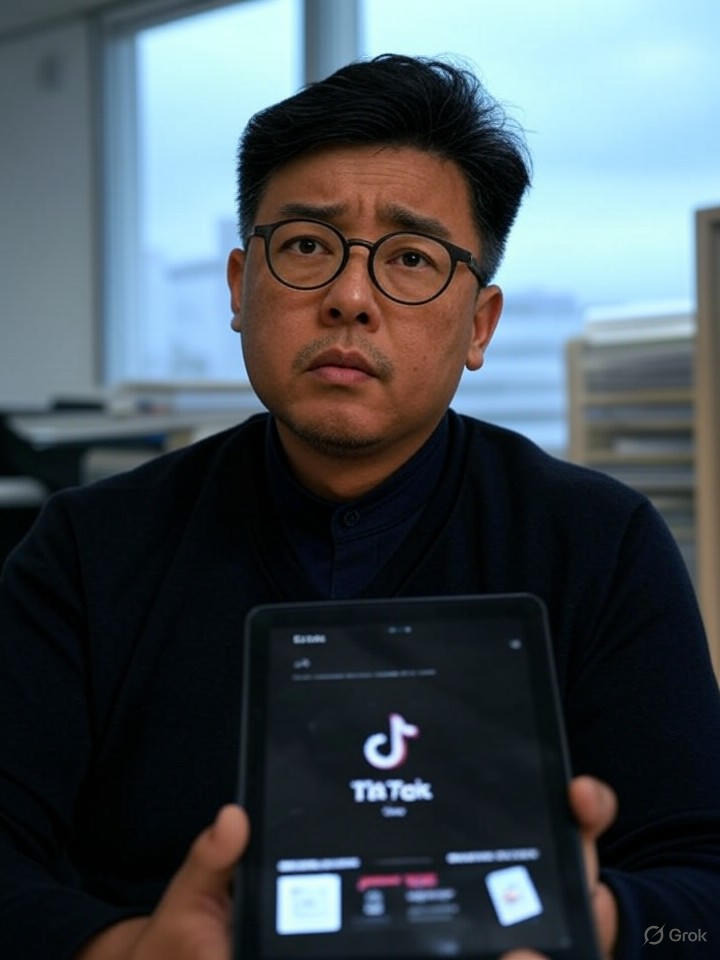

Sellers have taken to social media platforms, including X (formerly Twitter), to voice their concerns. Many express disappointment over the recent policy changes, which they believe prioritize TikTok’s financial interests over user experience and merchant autonomy. Discussions among sellers highlight a shift towards a pay-to-play model, as detailed in a Cahoot analysis, moving away from organic reach and necessitating significant investment in paid promotions to maintain visibility.

Wider Implications for E-Commerce

The timing of these changes is critical, occurring during a period of uncertainty regarding TikTok’s future in the U.S. market. According to an eMarketer report, marketers are reallocating budgets, with some turning to competing platforms like Instagram Reels and YouTube Shorts. Despite this, TikTok remains a dominant force in product discovery, with 60% of users finding new products through short-form videos, as reported by WebProNews.

The financial landscape is also changing, with commission rates on TikTok Shop expected to rise to 8% for certain categories in 2025, further constraining profit margins for merchants. Additionally, stricter rules for affiliates, as updated in BigSeller, will disqualify those who fail to meet performance thresholds.

In response to the changing environment, some merchants are collaborating with TikTok-certified “Shop Ads” experts to optimize their advertising strategies. Larger brands, such as Nike and E.l.f. Beauty, are adapting by focusing on live shopping and influencer partnerships to counteract the impact of the new advertising restrictions.

As the 2025 holiday season approaches, the true effects of these policies on merchant sales and overall e-commerce dynamics will become clearer. Industry experts warn that alienating sellers could undermine TikTok Shop’s growth, especially as competitors enhance their own commerce capabilities.

While TikTok’s innovations may yield short-term benefits, long-term success will depend on balancing the platform’s control with the needs of its merchants. The evolving landscape of social commerce will require adaptive strategies, including advanced targeting and optimized campaigns, to navigate the challenges posed by these new advertising mandates.