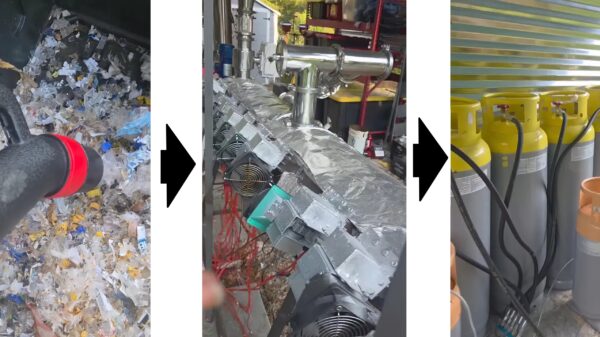

Rigetti Computing, Inc. has recently captured significant attention in the stock market following a major breakthrough in quantum technology. On July 16, 2025, the company announced that its 36-qubit quantum system achieved a remarkable 99.5% two-qubit gate fidelity. This advancement is crucial as it indicates the potential for quantum computers to perform operations with a low error rate, a necessary feature for solving complex real-world problems.

The breakthrough is particularly noteworthy because Rigetti employs a multi-chip modular design, which connects smaller chips instead of relying on a single large chip. This innovative approach not only enhances scalability but also positions Rigetti closer to developing quantum systems with thousands or even millions of qubits. Following this announcement, Rigetti’s stock price surged over 30% in one day, reflecting the market’s enthusiasm for this progress.

Analysts Optimistic About Rigetti’s Future

Several financial institutions have responded positively to Rigetti’s advancements. Cantor Fitzgerald has assigned an “Overweight” rating to the stock, predicting a target price of $15. Other analysts have set their price targets as high as $18, further bolstering investor confidence. Rigetti has been listed as a trending stock on various financial websites, which typically leads to increased trading activity and demand.

The recent analyst ratings indicate a strong belief in Rigetti’s growth potential within the burgeoning quantum computing sector. As interest in quantum technology intensifies, the outlook from analysts serves to enhance investor sentiment, potentially driving the stock price higher as more investors consider entering the market.

Solid Financial Foundation Fuels Innovation

Rigetti’s financial position is also a key factor in its current success. The company recently raised $350 million through a stock offering, increasing its cash reserves to approximately $575 million. Notably, Rigetti has no debt, which is uncommon for a technology startup operating in a research-intensive field. The company’s current ratio stands at 18.8, indicating a robust liquidity position that allows for continued investment in research and development without immediate funding concerns.

The quantum computing sector is experiencing rapid growth, with global investments surpassing $42 billion to date. Market researchers project that the industry could reach around $97 billion by 2035, and potentially $200 billion by 2040. Rigetti is well-positioned to capitalize on this growth, leveraging its superconducting technology and a $250 million partnership with Quanta Computer to expand its hardware capabilities and market reach.

Rigetti stands out among public companies solely focused on quantum computing, including competitors like D-Wave and IonQ. While these companies have also shown volatility in their stock prices, Rigetti’s unique modular approach and technical achievements differentiate it within the industry.

Upcoming Earnings Report and Potential Risks

Investors are eagerly awaiting Rigetti’s Q2 2025 earnings report, scheduled for release on August 12 after market close. This report is anticipated to provide insights into the company’s revenue, expenses, and strategic direction. If the results exceed expectations, it could propel the stock price further upward. Conversely, disappointing results may dampen current momentum.

Despite its promising developments, Rigetti faces challenges, including a lack of profitability. In the first quarter of 2025, the company reported revenue of approximately $1.5 million against operating expenses exceeding $23 million. Additionally, some insiders have sold shares, which can raise concerns among investors regarding stock valuation. The quantum computing landscape remains competitive and still in its early stages, indicating that building a fully commercial quantum computer will require further time, funding, and research.

From a trading perspective, Rigetti’s stock is currently showing strength, trading near the higher end of analysts’ price targets. Support is identified around $14 to $15, while resistance is expected near $18. With increased trading volume following the July announcement, investor interest appears robust; however, any failure to maintain support levels could lead to short-term corrections.

In summary, Rigetti Computing, Inc. is trending in the stock market due to its substantial technical advancements in quantum computing. The company’s modular chip design and high fidelity performance position it favorably against competitors. With strong analyst support and a solid financial foundation, Rigetti is poised for potential growth in the rapidly evolving quantum sector. The upcoming earnings report will be a critical indicator of the company’s trajectory and its ability to navigate the challenges ahead.