WASHINGTON — The latest analysis from the nonpartisan Congressional Budget Office (CBO) has revealed that the Senate’s revisions to President Donald Trump’s tax bill could significantly inflate the national debt, adding approximately $3.3 trillion from 2025 to 2034. This daunting projection presents yet another hurdle for Republican lawmakers who are striving to pass the bill by the President’s self-imposed July 4th deadline.

The CBO’s findings indicate a steep increase compared to the House-approved version of the bill, which was estimated to contribute $2.4 trillion to the debt over the next decade. Additionally, the analysis predicts a troubling rise in the number of uninsured Americans, with 11.8 million more individuals potentially losing health coverage by 2034 if the Senate bill is enacted. This figure surpasses the 10.9 million projected by the House bill.

Challenges Within the Republican Ranks

The CBO’s report intensifies the already existing divisions among Republicans regarding the bill’s provisions. Some party members are resisting proposals to cut spending on Medicaid and food aid programs, arguing that these measures are necessary to offset the $3.8 trillion in tax breaks initiated during Trump’s first term. However, others contend that these cuts do not go far enough.

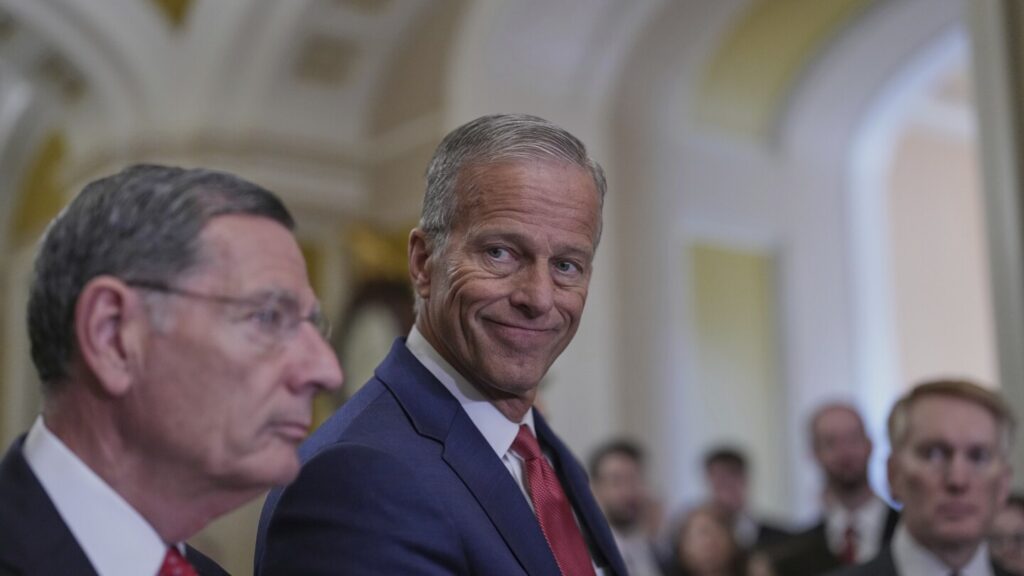

The tension was palpable during a Senate session on Saturday night, where a procedural vote on the legislation was delayed for hours. Vice President JD Vance and Republican leaders engaged in negotiations with several dissenting senators, ultimately advancing the bill with a narrow 51-49 vote. The legislative journey remains fraught with challenges, as further amendments are anticipated.

Disputes Over Economic Projections

Despite the CBO’s projections, many Republicans question the office’s estimates and the validity of its methodologies. To facilitate the bill’s passage, they are employing a different budget baseline that assumes the Trump tax cuts, set to expire in December, have already been extended, thereby rendering them ostensibly cost-neutral in the budget.

The CBO released an alternative analysis on Saturday, aligning with the GOP’s preferred approach, which suggests the Senate bill could reduce deficits by about $500 billion.

Critics, including Democrats and some economists, have denounced the GOP’s approach as “magic math,” arguing that it obscures the true financial implications of the tax cuts. Furthermore, under traditional scoring methods, the Republican bill would breach the Senate’s “Byrd Rule,” which prohibits legislation from increasing deficits beyond a ten-year horizon.

Political and Economic Implications

In a letter addressed to Oregon Senator Jeff Merkley, the top Democrat on the Senate Budget Committee, CBO Director Phillip Swagel confirmed that under conventional scoring, the Finance Committee’s portion of the bill, known as Title VII, would indeed increase deficits in years beyond 2034.

The controversy surrounding the bill underscores the broader ideological divide over fiscal policy and economic priorities. Proponents argue that the tax cuts will spur economic growth, ultimately offsetting the initial increase in debt. However, opponents caution that the long-term fiscal health of the nation could be jeopardized, with potential repercussions for future generations.

“The fiscal responsibility of this bill is highly questionable,” said a senior economist from a leading think tank. “While tax cuts can stimulate growth, the scale of these cuts and the resulting debt burden could have severe consequences.”

As the debate continues, the outcome of the Senate’s deliberations will not only shape the immediate fiscal landscape but also set a precedent for future legislative efforts. The stakes are high, with both political and economic ramifications hanging in the balance.

With the July 4th deadline looming, the coming weeks will be crucial as lawmakers navigate the complex interplay of policy, politics, and public opinion. The decisions made in this legislative session could have lasting impacts on the nation’s economic trajectory and the lives of millions of Americans.