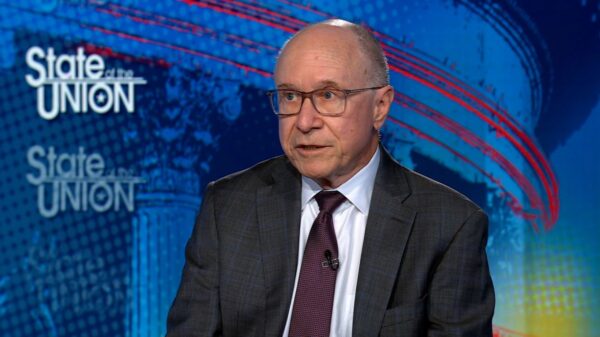

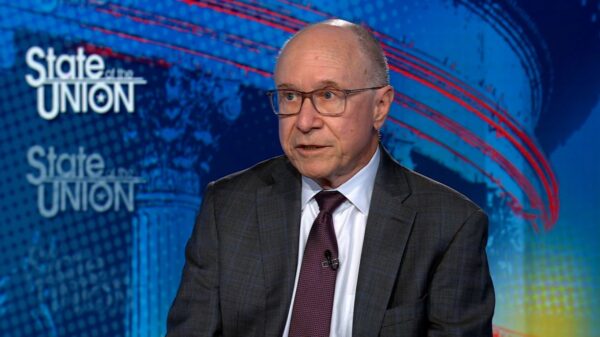

In 2013, Motorola attempted to carve out a niche in the competitive smartphone market with a bold initiative: assembling phones in the United States. This strategy, branded with the slogan “Made in the USA,” aimed to attract consumers who preferred domestically produced products. Dennis Woodside, former CEO of Motorola and now CEO of Freshworks, recounted this experience in a recent interview, highlighting the challenges that ultimately led to the factory’s closure just a year later.

Motorola’s attempt to manufacture the Moto X in Fort Worth, Texas, was part of a broader strategy to differentiate itself from industry giants like Apple and Samsung. Woodside noted that there was a segment of customers who would consider products made in the United States more favorably. However, despite the initial enthusiasm, the project proved unsustainable, and the Texas factory was shut down in 2014.

Proximity to suppliers and lower labor costs are significant factors for why most smartphone assembly occurs in Asia and South America. Woodside explained that the U.S. faces a shortage of skilled labor capable of handling the intricate assembly tasks required for smartphones. He emphasized that companies must develop a compelling value proposition to attract and retain employees, especially in a labor market where alternatives, such as retail and service jobs, are readily available.

Challenges of Domestic Manufacturing

The Moto X was marketed as a customizable device, allowing consumers to select specific design features. This customization necessitated local assembly, which Woodside believed was essential for meeting consumer demands. However, the components were sourced from Asia, creating a supply chain that Woodside described as “very fragmented.” Despite the unique selling points, the Moto X struggled in the market, with only 500,000 units sold in the third quarter of 2013. By May 2014, Motorola announced it would cease domestic assembly.

Woodside reflected on the challenges of training and retaining a workforce capable of producing smartphones. Workers often lacked experience with precision manufacturing, likening the assembly process to working with a “super tiny Lego set.” The U.S. manufacturing sector has been grappling with a skills shortage, facing significant job losses. According to the U.S. Bureau of Labor Statistics, approximately 11,000 manufacturing jobs were lost between June and July 2023, continuing a trend of difficulty in filling factory positions.

This situation is in stark contrast to China, where the manufacturing labor market is robust. In 2023, about 123 million people were employed in manufacturing in China, according to the country’s fifth economic census. Apple, for instance, benefits from a vast and experienced workforce in facilities like Foxconn’s Zhengzhou complex, which has historically assembled 350 iPhones per minute.

Lessons for Modern Manufacturing

The conversation around domestic smartphone production has resurfaced, particularly as U.S. economic policies encourage companies like Apple and Samsung to reconsider their manufacturing locations. President Donald Trump has put pressure on these companies to shift production to the United States, threatening tariffs on imports from China that could take effect on August 12, 2023.

As India emerges as the world’s leading exporter of smartphones to the United States, it faces potential tariffs of 25% on its exports when new rates are introduced. This evolving landscape presents both opportunities and challenges for tech companies looking to reestablish manufacturing in the U.S.

Woodside advises any company considering domestic smartphone production to thoroughly assess the availability of skilled labor. He warned that many businesses may overlook the complexities of training a workforce to handle specialized tasks, which could lead to operational challenges.

“Understanding the nature of the product you’re making, and thinking about whether you’re going to have to completely train the workforce, is something we didn’t quite anticipate,” he stated.

As the global economic environment shifts, the lessons learned from Motorola’s venture may provide critical insights for companies navigating the complexities of modern manufacturing. The potential for a U.S.-based smartphone industry exists, but it will require careful planning and an investment in workforce development to overcome historical obstacles.