Biodesix (NASDAQ:BDSX) has been downgraded to a “sell” rating by analysts at Wall Street Zen in a recent research report. This change, announced on Saturday, reflects shifting sentiments in the equity research community regarding the company’s stock performance. Meanwhile, Scotiabank lowered its price target for Biodesix shares from $60.00 to $40.00 while maintaining a “sector outperform” rating in a report issued on May 21, 2023.

The consensus rating for Biodesix among four equity research analysts remains a “Moderate Buy,” with an average target price set at $35.00, according to MarketBeat. This mixed analysis highlights the varying perspectives within the investment community.

Recent Earnings Report and Financial Outlook

Biodesix recently published its quarterly earnings on August 7, 2023, revealing a loss of $1.60 per share, which fell short of analysts’ expectations by $0.20. The company reported a negative return on equity of 269.67% and a negative net margin of 53.66%. Despite the disappointing earnings per share, Biodesix generated revenue of $20.02 million, exceeding forecasts of $18.47 million.

Looking ahead, Biodesix has projected guidance for fiscal year 2025, with analysts estimating an earnings per share (EPS) of -0.35 for the current fiscal year. These forecasts will be critical for investors evaluating the company’s financial health and growth prospects.

Insider Activity and Institutional Investments

In related news, Director Jack W. Schuler made a significant purchase of 174,418 shares of Biodesix on August 29, 2023, at an average price of $8.60 per share. The total transaction amounted to approximately $1.5 million, increasing his holdings to 1,220,327 shares, valued at around $10.5 million. This acquisition represents a 16.68% increase in his stake in the company. The transaction has been disclosed in filings with the Securities and Exchange Commission.

On the institutional front, various hedge funds have adjusted their positions in Biodesix. Notably, XTX Topco Ltd boosted its stake by 99.4% in the second quarter, now holding 205,647 shares valued at $58,000. Other institutional investors, including Birchview Capital LP and Monashee Investment Management LLC, have also increased their holdings, reflecting a growing interest in the company despite its recent challenges.

Corporate insiders collectively own 30.10% of Biodesix, while institutional investors and hedge funds account for 20.96% of the stock, indicating a notable level of confidence from both groups.

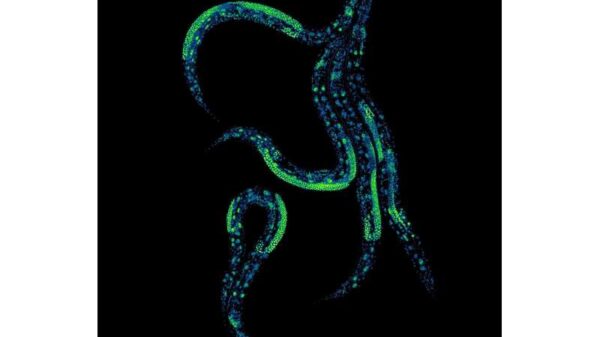

Biodesix operates as a data-driven diagnostic solutions company in the United States, specializing in blood-based lung tests. Its products, including the Nodify XL2 and Nodify CDT tests, are designed to assess lung cancer risk and aid in determining appropriate treatment pathways for patients with suspicious lung nodules.

The financial landscape for Biodesix is evolving, and these latest developments will be crucial for investors and analysts as they navigate the company’s performance and outlook in the coming months.