Legislators in both Florida and Ohio are advancing proposals to abolish property taxes amid rising homeowner discontent over increasing property values. This movement reflects a broader anti-tax sentiment as property taxes are becoming burdensome for many residents.

In Florida, lawmakers have introduced a remarkable seven proposed constitutional amendments aimed at reducing property taxes. Among these, two proposals stand out: one seeks to completely eliminate non-school homestead property taxes on owner-occupied primary residences, while the other suggests a phased elimination over a decade. This push for reform has gained traction as homeowners express frustration over escalating tax bills tied to increased property valuations.

Similarly, in Ohio, activists are actively gathering signatures to support a constitutional amendment that would eliminate all taxes on real property. This initiative has garnered attention as it resonates with the libertarian principle that taxation equates to theft, drawing public interest and support.

Voter sentiment in both states indicates a desire for property tax abolition, although residents are reluctant to see a decline in local services. According to an interview conducted by The Columbus Dispatch with voters heading to the polls in November 2025, nearly all expressed favor for abolishing property taxes but simultaneously wished to maintain the quality of local services funded by these taxes.

Despite the enthusiasm for tax cuts, neither Florida’s proposed reforms nor Ohio’s initiatives include any clear plans to offset the resulting revenue loss. The two Florida measures that intend to eliminate homestead property taxes contain provisions preventing local governments from cutting law enforcement funding. In Ohio, the nonprofit organization Citizens for Property Tax Reform has suggested alternatives like increasing sales taxes and local school district income taxes rather than proposing cuts to government spending.

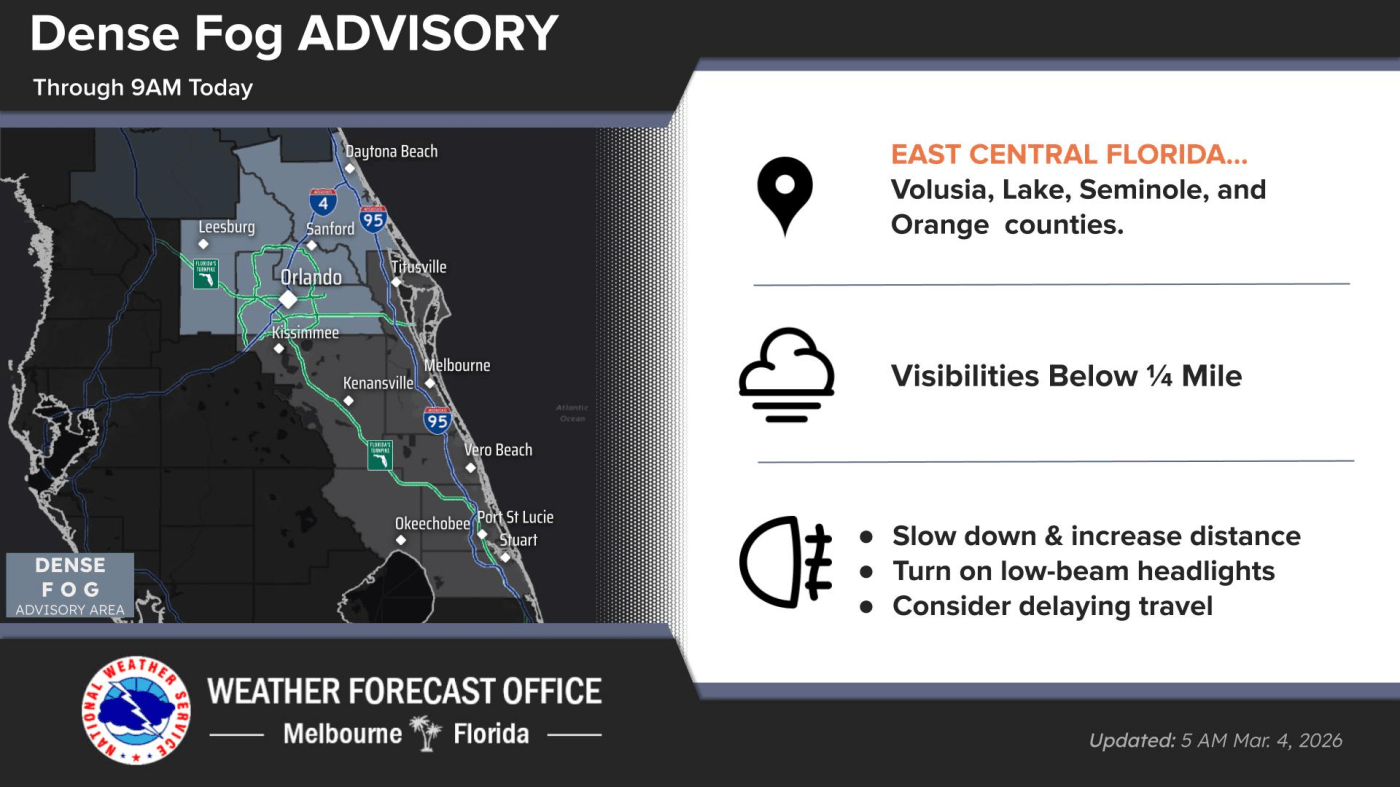

Replacing lost property tax revenues poses a significant challenge. The Tax Foundation estimates that Florida would need to raise its average combined state and local sales tax rate from 7 percent to 15 percent to compensate for the revenue shortfall. In Ohio, a similar increase would see the rate rise from 4.2 percent to 12.6 percent. Given that property taxes account for nearly 30 percent of local government funding in both states, finding alternative revenue sources without disrupting local services is a complex issue.

The implications of reducing or eliminating property taxes extend beyond immediate financial concerns. Milton Friedman characterized property tax, particularly on unimproved land, as the “least bad tax,” suggesting it is less detrimental to economic activity compared to sales or income taxes. Property taxes are less prone to distort economic behavior, as individuals and businesses can relocate to avoid higher local taxes, whereas real estate generally remains fixed in place.

Furthermore, property taxes are predominantly levied by local governments, providing a direct link between tax revenue and local services. In Ohio, property taxes contribute to approximately 65 percent of local government revenues, while in Florida, they account for about 73 percent. This creates a level of accountability for local governance, allowing residents to see a clear correlation between their tax contributions and the services they receive.

While the idea of cutting property taxes is appealing, it is crucial to consider the potential consequences. If the proposed cuts lead to reductions in essential services or shift the tax burden to other areas, the overall economic efficiency may suffer. Effective fiscal management requires a balanced approach to taxation that ensures services remain funded while addressing homeowners’ concerns about rising property taxes.

As Florida and Ohio navigate these proposals, the outcomes will likely impact local economies and governance structures significantly. The debate surrounding property taxes reflects broader societal values regarding taxation, public services, and community funding.