Discussions among Republican lawmakers are intensifying regarding whether President Donald Trump should dismiss Jerome Powell, Chair of the Federal Reserve. While some members urge Trump to remove Powell, others advise caution and patience. This uncertainty comes after Trump indicated during an Oval Office meeting that he was contemplating Powell’s removal, according to a White House official and a second source.

By the following day, Trump softened his stance, stating, “I don’t rule out anything but I think it’s highly unlikely. Unless he has to leave, fraud.” Such comments have notable implications for the financial markets, contributing to fluctuations. Following the president’s remarks, the Dow Jones Industrial Average rose by half a percent, while the S&P 500 gained 0.3 percent, demonstrating Trump’s significant influence over investor sentiment.

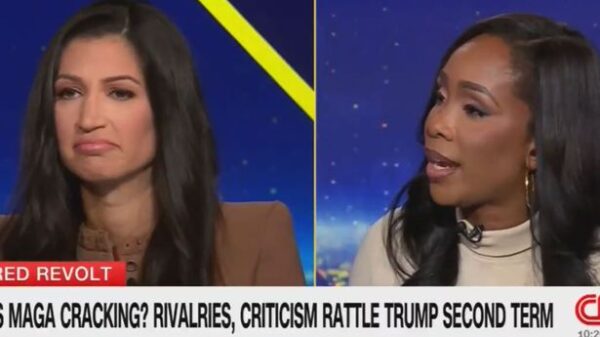

The divide within the GOP is evident, with some senators expressing concerns about the impact of firing Powell. Senator Mike Rounds of South Dakota emphasized the importance of maintaining the Federal Reserve’s independence. He stated, “Long term, the markets watch very carefully the independence of the Federal Reserve.” Rounds believes that preserving Powell’s position would benefit Trump in the long run, especially as the time approaches to consider reducing interest rates.

When asked about who is advising Trump on this issue, Rounds expressed uncertainty, stating, “I don’t know who that would be.” He hopes that Treasury Secretary Scott Bessent is aligned with this perspective. Meanwhile, Senator John Hoeven of North Dakota noted mixed sentiments within the GOP conference, indicating that opinions vary depending on whom one asks.

In the House of Representatives, the views on Powell’s future also differ. Representative Anna Paulina Luna of Florida voiced strong support for Trump to act decisively, stating, “Jerome Powell better lower those interest rates… If he doesn’t lower rates he will be FIRED.” Conversely, Representative Byron Donalds, who is running for governor of Florida, remains undecided about Powell’s removal. He acknowledged Trump’s frustrations regarding current interest rates but has not yet taken a position on the matter.

Reports surfaced that Trump drafted a letter to remove Powell, which he discussed during the Oval Office meeting. However, the following day, he refuted those claims, stating, “not true,” and denied drafting any letter. Earlier this week, Bessent mentioned that there is a “formal process” underway for selecting Powell’s successor, although Powell’s term as chair ends next year and his term as a governor extends to 2028.

Historically, no president has dismissed a Federal Reserve chair, raising questions about the legal authority of such an action. Trump’s primary frustration with Powell revolves around the Federal Reserve’s decision to maintain interest rates, which he believes should have been lowered to stimulate the economy. Powell has indicated that the Fed’s current stance considers the impact of Trump’s tariffs, which have begun to influence pricing in consumer markets.

As of June 2023, the consumer price index showed a rise to a 2.7 percent annual increase, up from 2.4 percent in May, likely reflecting tariff-related price increases. Powell acknowledged that the Fed’s decisions would have been different if not for the tariffs, stating, “I think that’s right.” This divergence between Trump’s economic strategies and the Fed’s policies complicates the landscape.

Despite recent tax cuts aimed at stimulating economic growth, projections suggest limited impact on overall growth. Economist Kevin Rinz criticized the approach, arguing, “If President Trump’s goal was to get interest rates down, doing nothing would’ve been a much better course of action than imposing sweeping tariffs.” He added that antagonizing the Fed only complicates efforts to stabilize prices and lower rates.

As the GOP grapples with differing opinions on Powell’s future, the implications for economic policy and market stability remain significant. The ongoing discussions reflect the broader challenges facing the Trump administration as it navigates complex economic issues.