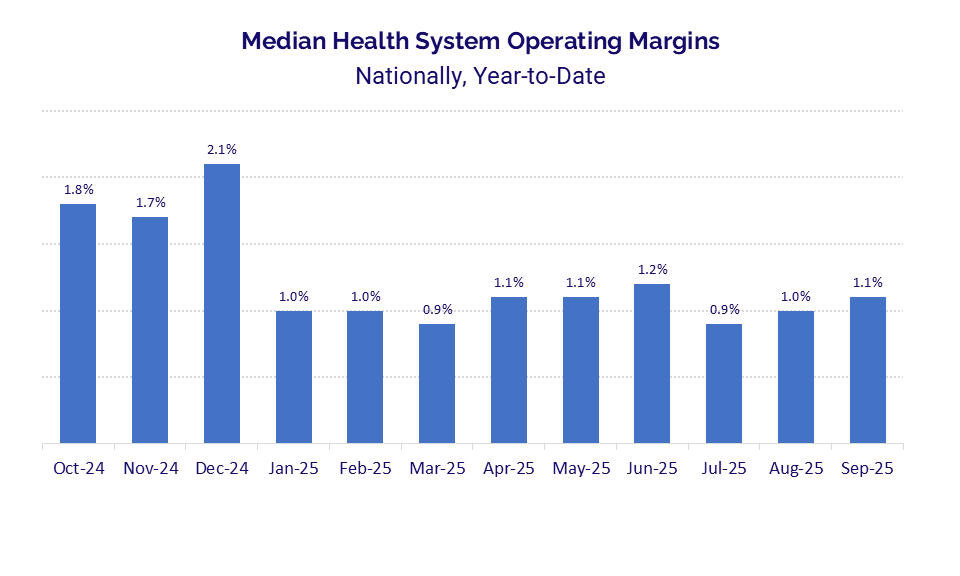

U.S. healthcare organizations are grappling with persistent financial challenges as operating margins remain precariously low at 1.1% despite an increase in overall revenue at the end of the third quarter of 2025. According to data from Strata Decision Technology, while gross revenue saw consistent growth, escalating expenses, particularly in non-labor categories, have overshadowed these gains.

Rising Non-Labor Costs Impact Financial Health

Rapidly increasing non-labor expenses have significantly affected hospital financial performance. Specifically, drug expenses soared by 12.8% year-over-year (YOY), and supply costs climbed 12.1% during the same period from September 2024 to September 2025. These surges contributed to a total non-labor expense increase of 9.3%, which far exceeded the 5.0% rise in labor expenses. Overall, total hospital expenses increased by 7.5% YOY.

Financial pressures varied across the United States. Hospitals in the Midwest reported the steepest YOY increase in drug expenses at 17.3%, closely followed by the West at 15.7%. “Operating margins have faltered throughout the first three quarters of 2025 as healthcare organizations feel the full weight of rising expenses,” stated Steve Wasson, Chief Data and Intelligence Officer at Strata Decision Technology. He emphasized the need for organizations to manage expenses rigorously to maintain performance amidst these economic challenges.

Outpatient Care Drives Revenue Growth

In contrast to rising expenses, there has been a notable shift in patient demand towards outpatient care, which has spurred significant increases in gross revenue. Outpatient visits rose by 9.8% nationally in September, with the South and Midwest leading this trend. Inpatient admissions also saw a 5.3% YOY increase, while observation visits rose by 1.5%. Emergency visits, however, experienced a slight decline of 0.5%.

Gross operating revenue reflected these utilization patterns, climbing by 11.4% YOY, driven largely by a 12.8% increase in outpatient revenue and a 9.8% rise in inpatient revenue. This shift illustrates the evolving landscape of healthcare demand, as patients increasingly seek outpatient services.

Signs of Relief for Physician Practices

Physician practices have begun to experience some financial relief in 2025, marking a shift in operational dynamics. The median investment necessary to support practice operations decreased YOY for the first time, falling to $311,264 per physician full-time equivalent (FTE) in the third quarter. This figure represents a decrease of 4.7% from the previous quarter and 1.8% from Q3 2024.

While median total expenses per physician FTE remain high at around $1.1 million, which is up 3.9% YOY, there was a slight decrease of 1.3% compared to Q2 2025. This trend provides a glimmer of hope for physician practices navigating the complexities of the healthcare environment.

The insights presented in this report draw from data within Strata’s StrataSphere® database and Comparative Analytics, representing over 650 hospitals and approximately 135,000 physicians, which collectively account for about 25% of all provider expenditures in U.S. healthcare. The findings highlight the pressing need for healthcare organizations to adapt to the evolving landscape while managing expenses effectively to sustain their financial health.