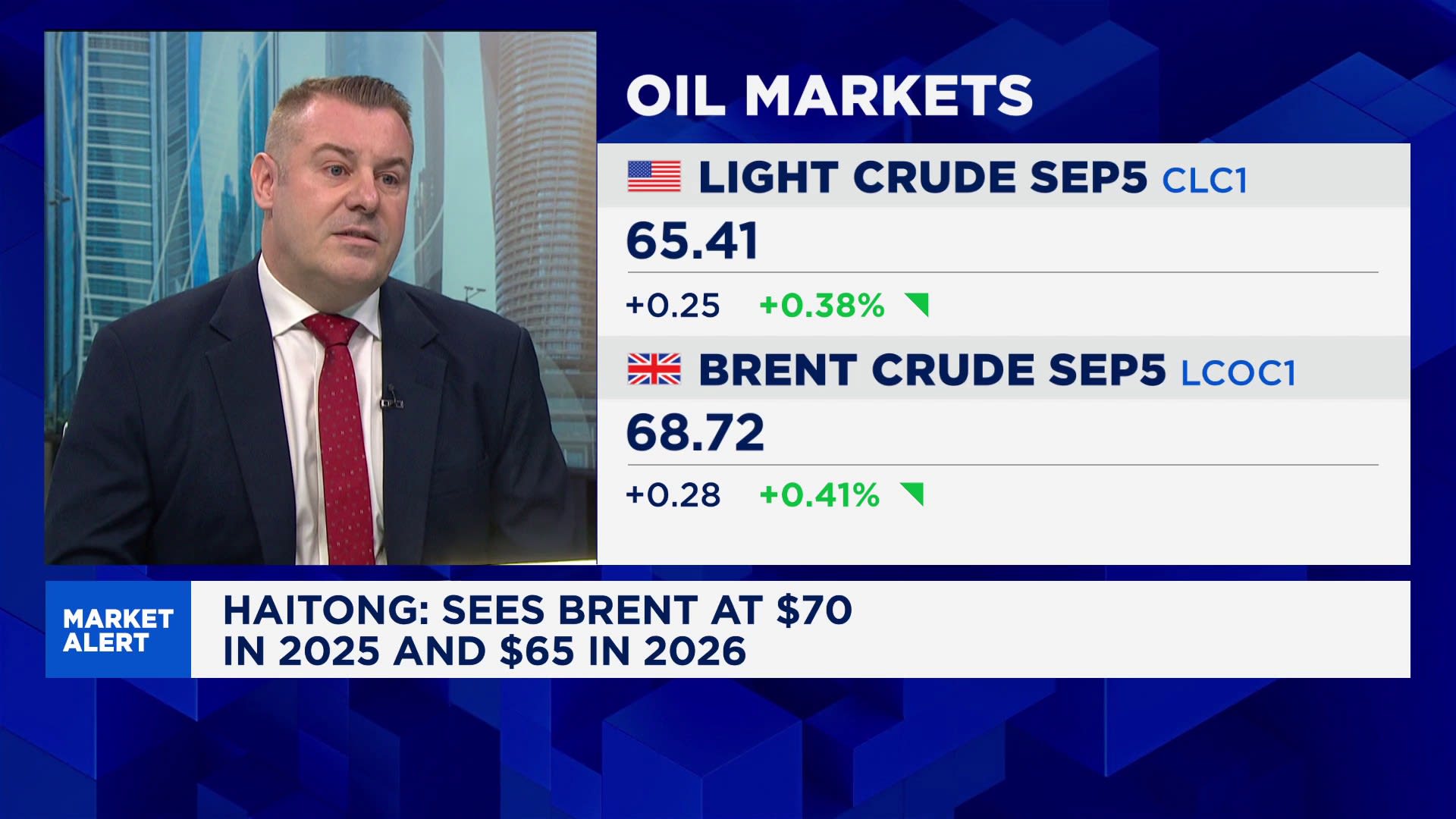

Oil prices are set to decline due to a significant drop in demand, according to a report from Haitong Securities. The analysis points to a combination of factors contributing to this downward trend, particularly the slowing economic growth in key markets like China and the United States.

The report indicates that global oil demand is expected to decrease by approximately 1.2 million barrels per day in the upcoming months. This anticipated reduction is largely attributed to weaker consumption patterns as economic activities in major economies show signs of stagnation. The Organization of the Petroleum Exporting Countries (OPEC) has also noted similar trends, which could further impact pricing.

Market Responses and Future Projections

In response to the projected decline in demand, oil prices have already shown signs of falling in recent trading sessions. Analysts predict that if the current trends continue, prices could experience a drop of up to 15% by the end of the year. This decline could have significant implications for the energy sector, influencing everything from production rates to investment strategies.

Furthermore, the report highlights the potential for increased volatility in the oil market as geopolitical tensions and economic uncertainties persist. The situation requires close monitoring, as any shifts in supply due to political events could counterbalance the current demand-driven price decline.

Impacts on Consumers and Businesses

The anticipated drop in oil prices may offer some relief to consumers facing rising costs in other areas, such as transportation and goods. Lower oil prices typically lead to decreased fuel costs, which can help ease inflationary pressures in several economies.

For businesses, particularly those in the energy sector, the falling prices may require strategic adjustments. Companies reliant on oil revenues may need to reassess their projections and operational strategies to adapt to the changing market landscape.

As the situation develops, stakeholders across the globe will be watching closely. The interplay between demand, geopolitical tensions, and economic conditions will determine the trajectory of oil prices in the coming months.

In summary, as Haitong Securities reports, a notable decline in oil demand is expected to drive prices down significantly, presenting both challenges and opportunities for consumers and businesses alike.