Recent advancements in neurology research and development (R&D) are prompting discussions about the sector’s potential as a lucrative target for mergers and acquisitions (M&A) in the biopharmaceutical industry. The ongoing evolution in understanding brain functions may position neurology as a more attractive area for investment, despite its historical reputation for being high-risk.

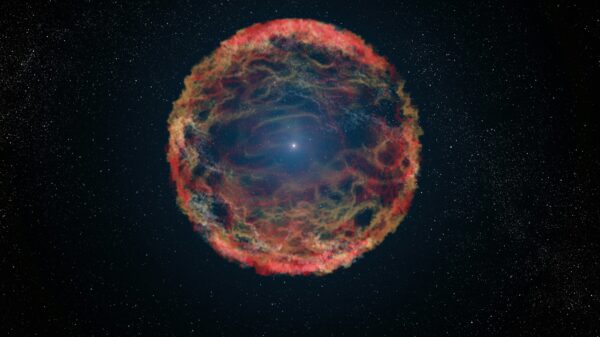

Traditionally, the field of neurology has been viewed as fraught with uncertainties. The mechanisms of the brain remain less understood compared to other organ systems. This knowledge gap has deterred some investors. However, the landscape is shifting. Innovative technologies and breakthroughs in neurology are beginning to reshape perceptions and open new avenues for development.

Shifting Investment Landscape

As of 2023, the biopharmaceutical sector is witnessing a surge in interest in neurology. Companies are increasingly focusing on neurological disorders, which affect millions globally. Conditions such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis are receiving heightened attention from researchers and investors alike.

According to data from industry analysts, the global market for neurodegenerative disease therapies is projected to reach approximately $30 billion by 2025. This forecast underscores the growing recognition of the financial potential within the neurology sector. Investment firms are beginning to reassess the risks associated with neurology, driven by recent breakthroughs in understanding the brain and the development of novel treatment approaches.

The rise in digital health technologies, particularly artificial intelligence and machine learning, is also playing a crucial role. These innovations are enhancing research capabilities and accelerating the discovery of new therapies. For instance, AI-driven platforms are aiding in the identification of potential drug candidates, significantly reducing the time and costs associated with traditional drug development processes.

Market Dynamics and Company Strategies

Several biopharmaceutical companies are actively pursuing collaborations and strategic partnerships to capitalize on these developments. For example, companies like Biogen and Amgen have invested heavily in neurology-focused research, recognizing the sector’s potential for significant returns. Their commitment to developing innovative therapies is indicative of a broader trend within the industry.

Financial analysts suggest that the increasing collaboration between tech firms and biopharmaceutical companies will further enhance the attractiveness of the neurology sector. As more players enter the market, competition is likely to intensify, which could lead to a flurry of M&A activity. This could ultimately reshape the landscape of the biopharmaceutical industry as companies seek to expand their portfolios and gain competitive advantages.

In conclusion, the recent strides in neurology R&D are not only transforming our understanding of the brain but are also altering the investment dynamics within the biopharmaceutical sector. The shift towards viewing neurology as a viable investment opportunity, rather than a high-risk gamble, could lead to significant M&A activity in the coming years. As companies continue to innovate and explore new therapies, the potential for growth in this field appears promising.