Purchasing health insurance for the first time can be a daunting task, particularly for individuals in India. With various options available, potential buyers often feel overwhelmed by technical jargon and similar-looking plans. To facilitate a more straightforward decision-making process, it is essential to consider one’s life stage, preferred hospitals, and acceptable levels of risk.

Understanding Your Needs and Budget

Start by aligning your health insurance needs with your current life stage and financial situation. A single professional, a young couple, or a family supporting elderly parents will likely have different requirements. Consider the hospitals you would use in emergencies and any pre-existing health conditions that may affect your insurance choices. The primary objective of medical insurance is to transform unpredictable hospital expenses into manageable annual premiums, thus reducing financial stress.

Determining the appropriate level of coverage is crucial. Instead of pursuing arbitrary high coverage amounts, assess typical room categories and procedures that are relevant for your age group. For instance, if a private room is your preference, verify how the policy addresses room rent and whether a higher category could lead to reduced payouts at the time of a claim.

Key Features for First-Time Buyers

A robust cashless network is essential, as it alleviates the need to arrange immediate funds during hospital admissions. Opt for policies that include hospitals within your vicinity and investigate the pre-authorization process, which will inform you of the necessary documentation required upon admission.

Many insurance plans impose waiting periods concerning specific illnesses and declared conditions. If you’re considering starting a family, reviewing maternity coverage is essential. Understanding the continuity of coverage will help ensure you are not caught off guard by any limitations.

Room rent policies significantly influence overall billing. Policies with room rent caps may lead to proportionate deductions if you select a more expensive room during a claim. First-time buyers often prefer policies with clear rules to minimize unexpected costs, even if the premium is slightly higher.

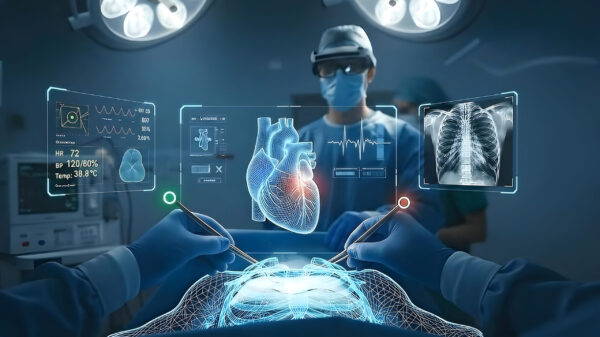

With healthcare increasingly shifting towards day-care procedures and outpatient benefits, it is important to review how your chosen policy defines these modern treatments. Understanding what constitutes a day-care procedure can prevent disputes during claims.

Many plans offer rewards for claim-free years or restore your base cover under certain conditions. Familiarize yourself with the triggers and limitations of these benefits to make informed choices.

Reading exclusions is vital; common exclusions include elective procedures, non-medical expenses, and treatments related to hazardous activities. Policies may also have temporary exclusions for certain illnesses shortly after purchase. If any details are unclear, request written explanations that cite the relevant policy clauses.

When comparing insurance plans, focus on aligning features before considering premiums. A feature comparison matrix can be particularly useful:

– **Cashless Network**: Reduces stress during admissions.

– **Room Rules**: Helps avoid proportionate deductions.

– **Waiting Periods**: Impacts claim timing.

– **Co-Pay and Deductibles**: Determine your share of costs.

– **Support Process**: Shapes the overall claim experience.

To create a practical shortlist, filter policies based on the hospitals you plan to use. Review room policies, sub-limits, and waiting periods in the policy documentation. This method ties your choices to real-world usage rather than relying on marketing language.

Understanding policy documents can be challenging. Focus on key sections that define hospitalization, day-care, and modern treatments, as well as disease-specific limits and co-payment clauses. If you encounter any ambiguity, seek clarification in writing to minimize disputes later.

Purchasing health insurance can be done online for convenience, or through assisted channels for personalized support. Both options can be effective if you ensure that the proposal form is accurately completed and all documents are retained.

Before finalizing your health insurance plan, ensure that your shortlist includes hospitals you are likely to use. Confirm the acceptability of room categories and sub-limits, and ensure that waiting periods and co-pays are clear. Keep a record of policy documents and helpline numbers.

In conclusion, the right health insurance plan is one that you can renew without stress. For first-time buyers, focus on your preferred hospitals, budget, and comprehensible policy details. With a clear method and a shortlist shaped by practical needs, you can confidently navigate the health insurance landscape and establish reliable protection for your future.