Senator Elizabeth Warren is raising concerns about a new proposal that could allow private equity investments in 401(k) retirement plans. Traditionally, these plans have focused on publicly traded stocks and bonds, but private equity has become an increasingly significant part of the investment landscape. Warren’s scrutiny comes amid discussions about “democratizing” access to these investments, which are often less transparent and more costly than conventional securities.

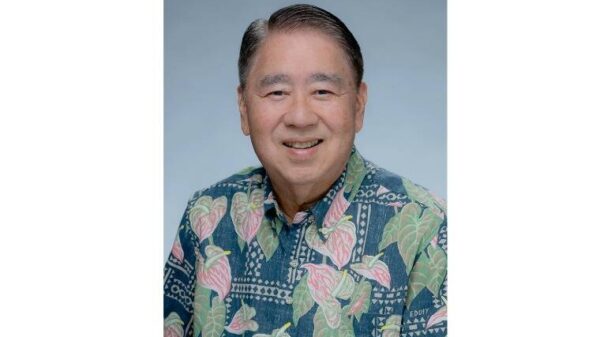

Warren recently sent a letter to Empower, one of the largest workplace retirement plan recordkeepers, questioning its decision to let plan sponsors include private equity in their offerings. Empower serves approximately 90,000 corporate, government, and nonprofit employers. In response, Ed Murphy, the CEO of Empower, likened the move to the inception of 401(k) plans decades ago. He argued that just as these plans opened up public market investments, the inclusion of private equity could similarly expand opportunities for everyday investors.

According to Murphy, there are now significantly fewer publicly traded companies than there were three decades ago, while the global private equity market has grown to approximately $13 trillion. This shrinkage in public investment options, he suggests, necessitates a shift towards private markets for those saving in defined contribution plans. He emphasized that private equity investments would be introduced with “guardrails” to protect investors.

Murphy stated, “Private markets investing is not for everyone… Empower is not advocating for unregulated or unmanaged access to complex asset classes.” Specific measures would include ensuring that investment managers are chosen by plan sponsors and adhere to ERISA standards, which set high fiduciary requirements in the U.S. Furthermore, only participants with managed accounts would gain access to private equity investments, which would represent only a portion of a broader collective investment trust also comprising public securities.

Warren’s response to Empower, released on July 22, 2025, expressed her intent to ensure that all investors, regardless of their financial status, can build secure futures through proper investment channels. However, she criticized Empower’s lack of clarity on how it would mitigate the inherent risks associated with private market investments. She pointed out that the response did not sufficiently explain the benefits of allowing retirees to invest in these “risky” and “expensive” markets, primarily benefiting private equity funds.

In her letter, Warren requested more detailed information about Empower’s partnerships with private firms, fee structures, and the incentives at play. She set a deadline for the company to respond to her inquiries by July 25, 2025.

As this debate unfolds, the Office of the Investor Advocate at the Securities and Exchange Commission announced plans to examine the implications of including alternative investments like private equity in retirement savings plans during fiscal year 2026. This inquiry reflects a growing concern over the potential risks and rewards of such investments for retail investors. The outcome of these discussions may significantly impact how workplace retirement plans evolve in the future.