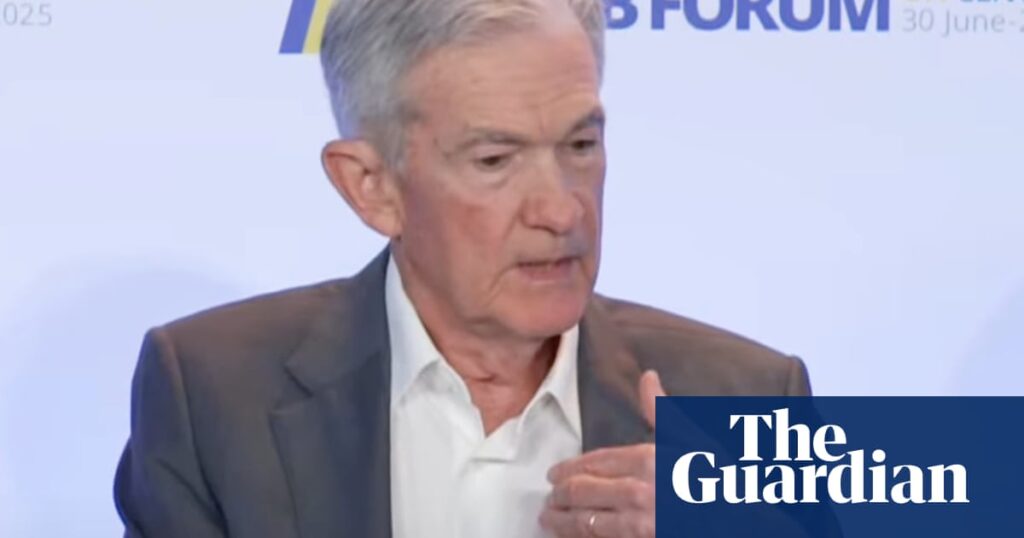

The chair of the Federal Reserve, Jerome Powell, has attributed the inability to implement immediate interest rate cuts to the tariffs imposed by former President Donald Trump. This revelation comes amid ongoing pressure from Trump, who has persistently called for reduced borrowing costs in the U.S. economy.

On Tuesday, Trump criticized Powell, stating, “Anybody would be better than J Powell. He’s costing us a fortune because he keeps the rate way up.” This comment followed Powell’s remarks at a European Central Bank (ECB) event in Portugal, where he emphasized the Federal Reserve’s cautious approach in evaluating the inflationary effects of Trump’s trade policies.

Impact of Tariffs on Monetary Policy

During a panel discussion with central bankers in Sintra, Powell explained, “In effect, we went on hold when we saw the size of the tariffs. Essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs. We didn’t overreact; in fact, we didn’t react at all. We’re simply taking some time.”

When asked if the Federal Reserve would have considered further cuts to its key Fed funds rate, currently at a target range of 4.25-4.5%, in the absence of tariffs, Powell affirmed, “I think that’s right.”

Economists generally agree that tariffs are likely to be inflationary, as the costs tend to be passed on to consumers. However, the effects remain uncertain, with some retailers potentially absorbing costs or switching suppliers to mitigate impacts.

“We haven’t seen effects much from tariffs, and we didn’t expect to by now. We’ve always said the timing, amount, and persistence of the inflation would be highly uncertain, and it’s certainly proved that,” Powell noted.

Political Tensions and Economic Speculation

Trump’s consistent efforts to undermine Powell have been evident since his return to the White House. He has frequently resorted to derogatory remarks, calling Powell a “major loser” and “very dumb,” while reportedly considering replacing him before his term concludes in May next year.

At the ECB event, when these personal attacks were mentioned, Powell received supportive applause from the audience and his fellow central bankers on the panel.

The U.S. Treasury Secretary, Scott Bessent, has hinted that the Trump administration might utilize the opportunity of a vacant seat on the Fed’s board to appoint a potential successor. “There’s a seat opening up … in January. So we’ve given thought to the idea that perhaps that person would go on to become the chair when Jay Powell leaves in May,” he told Bloomberg TV.

Speculation that Trump could replace Powell early has been one factor behind the depreciation of the dollar, which has suffered its weakest first-half in more than 50 years.

Global Economic Perspectives

While Powell addressed the U.S. economic landscape, ECB President Christine Lagarde emphasized that it was premature to declare “mission accomplished” on inflation in the eurozone. Meanwhile, Bank of England Governor Andrew Bailey noted signs of a slowing jobs market in the UK.

This development follows a period of heightened scrutiny on central banks worldwide as they navigate complex economic challenges. The interplay of tariffs, political dynamics, and global economic conditions continues to shape monetary policy decisions.

As the Federal Reserve remains vigilant, Powell’s comments highlight the intricate balance between economic policy and political pressures. The coming months will be crucial in determining the trajectory of U.S. interest rates and their broader implications for the global economy.