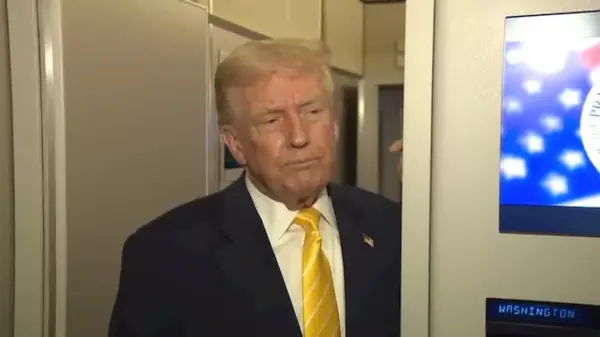

Trade tensions between the United States and Taiwan have intensified as President Donald Trump demands that Taiwan Semiconductor Manufacturing Co. (TSMC) acquire a 49% stake in Intel Corp. and invest an additional $400 billion in the U.S. This proposal is tied to a potential reduction of the current 15% tariff on Taiwanese goods, a move that could significantly alter the global semiconductor landscape.

According to a report by Reuters dated August 4, 2025, the U.S. administration is leveraging these demands to align trade policy with national security goals. The negotiations have unfolded under a veil of secrecy, with Taiwanese officials indicating that any agreement will be subject to parliamentary review. This pressure follows Trump’s previous imposition of a 32% reciprocal tariff on Taiwanese imports in April 2025, which initially excluded semiconductors but has since raised concerns about broader impacts on the technology supply chain.

Economic Impact and Industry Reactions

The implications of these demands extend beyond trade negotiations, with profound economic ramifications anticipated for both nations. A Tax Foundation analysis published on August 4, 2025 estimates that Trump’s tariffs could lead to an average tax increase of $1,300 per U.S. household this year. If TSMC complies with the investment demands, it could accelerate the shift of advanced chip manufacturing to the United States, but at the risk of straining Taiwan’s economy, where over 70% of technology exports are directed to the U.S., according to recent data from Focus Taiwan.

Discussions on social media platforms have further amplified attention on these developments. Financial analysts and industry insiders have voiced concerns about the potential for TSMC to bolster U.S. chip production through these unprecedented financial commitments. While some analysts highlight the low likelihood of TSMC meeting such conditions, the overarching sentiment reflects alarm regarding the potential disruption of existing supply chains.

Geopolitical Considerations and Future Scenarios

This situation is not merely a matter of trade; it reflects a strategic maneuver to counterbalance China’s growing influence in the semiconductor industry. A Foreign Policy Research Institute article from July 11, 2025 underscores the heightened anxieties across East Asia regarding the reliability of U.S. commitments. In response, Taiwan’s government has cautiously offered to enhance U.S. imports and eliminate tariffs on American goods. However, the opposition party, the Kuomintang, has criticized these moves, viewing them as detrimental to President Lai Ching-te’s strategy aimed at strengthening ties with the U.S. against China.

As negotiations progress, the technology sector braces for potential volatility. The conversation around these developments has sparked widespread debate among tech enthusiasts and professionals, particularly on forums like Reddit. Users speculate on the possible impacts on stock prices for both TSMC and Intel, echoing sentiments from a BBC analysis published on July 31, 2025 that highlights how Trump’s erratic trade policies could inflate U.S. prices.

The stakes are high as the negotiations continue. If TSMC proceeds with the Intel acquisition, it may inject much-needed momentum into U.S. semiconductor initiatives, complementing TSMC’s existing $65 billion investment in manufacturing facilities in Arizona. Yet, critics warn that such a move could alienate a vital ally and potentially strain Taiwan’s economic stability as it navigates increased defense spending pressures amidst tariff threats.

For industry leaders, the scenario presents a complex dilemma: comply with U.S. demands and risk diminishing Taiwan’s competitive edge or resist and face elevated trade barriers. As Trump’s unpredictable trade strategies unfold, the outcome of these negotiations may redefine global technology alliances and reshape the semiconductor industry landscape for years to come.