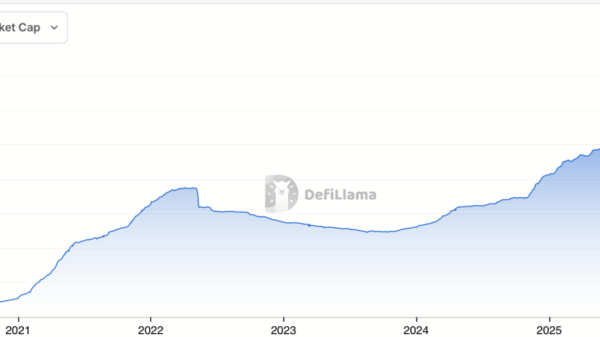

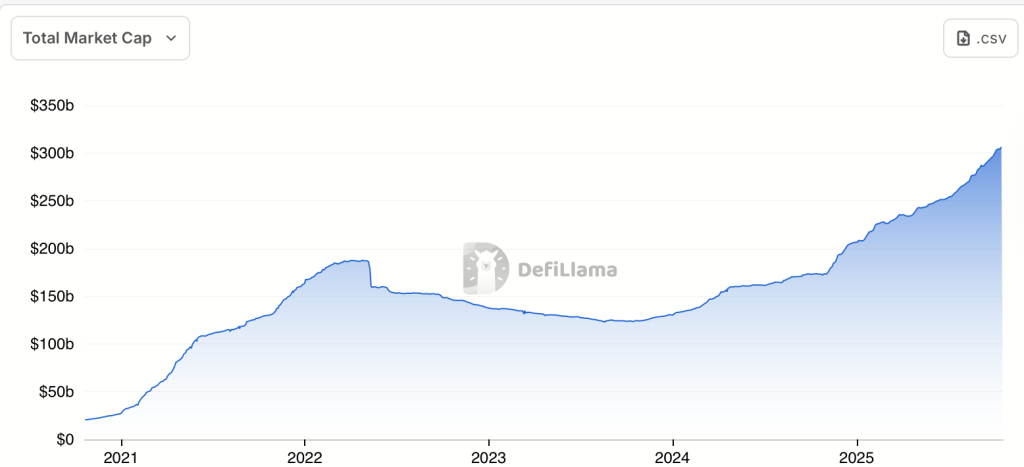

The total supply of stablecoins has reached a record high of $304.5 billion, creating significant liquidity poised to enter the cryptocurrency market. This surge signals potential growth for Bitcoin (BTC), Decentralized Finance (DeFi), and various altcoins, setting the stage for what some analysts anticipate could be the next major bull run.

The rise in stablecoin reserves reflects increasing investor confidence and a readiness to reallocate funds into higher-yield opportunities within the crypto ecosystem. Stablecoins, which are typically pegged to the U.S. dollar, provide stability and seamless transfer capabilities, making them integral to the functioning of the cryptocurrency market. As stablecoin supply grows, it often precedes substantial price movements in both Bitcoin and DeFi tokens, indicating that a significant shift in market dynamics may be on the horizon.

Market Momentum and Institutional Interest

Currently, Bitcoin is trading near $107,000, while top altcoins such as Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) are experiencing a steady recovery following recent market pullbacks. This positive sentiment is bolstered by renewed institutional interest and increasing on-chain activity, which further supports the case for a potential market rally.

Analysts suggest that the influx of stablecoins into the market could have far-reaching implications, particularly for DeFi platforms and tokenized real-world assets (RWAs). As lending platforms, decentralized exchanges, and yield farms attract more stablecoin inflows, they are becoming increasingly essential components of the financial landscape. The ongoing improvements in security and the introduction of institutional-grade protocols are further legitimizing DeFi as a critical financial layer.

Catalysts for Future Growth

The growing interest in tokenizing real-world assets is also noteworthy. Financial institutions, including BlackRock and Standard Chartered, are exploring blockchain-based settlement solutions using stablecoins as their primary medium. This trend suggests a shift towards integrating traditional financial assets into the cryptocurrency space, which could significantly enhance market liquidity.

Several factors may trigger this vast liquidity pool to flow back into the market. Regulatory clarity, increased institutional adoption, and macroeconomic changes are all potential catalysts that could encourage capital to move on-chain. A favorable regulatory move or major financial institution adopting stablecoin payments could potentially ignite the next liquidity supercycle in the crypto market.

In conclusion, the record-breaking stablecoin supply of $304.5 billion represents more than just idle capital; it is a significant indicator of forthcoming growth in the cryptocurrency sector. With the acceleration of DeFi, the rise of tokenized real-world assets, and broader blockchain adoption, this liquidity could soon re-enter the market, potentially driving prices for Bitcoin, Ethereum, and various DeFi tokens to new heights.