Republic Capital Group, a prominent investment bank, has announced its role as the financial advisor to Private Advisor Group during its recent minority investment by LPL Financial Holdings Inc. This transaction marks a significant development in their nearly three-decade relationship and reflects a strategic enhancement for both firms. With $41.3 billion in assets under management (AUM) as of June 30, 2025, Private Advisor Group aims to leverage this partnership to promote growth and innovation within its advisory community.

Strengthening Strategic Ties

The acquisition of a minority stake by LPL Financial, which is traded on the Nasdaq under the symbol LPLA, will solidify the strategic relationship between the firms. This collaboration is expected to bolster Private Advisor Group’s long-term objectives, which include driving advisor growth, enhancing service offerings, and achieving operational excellence. LPL joins Merchant Investment Management and six legacy shareholders as a minority owner, diversifying the ownership structure and enhancing stability.

Private Advisor Group’s leadership has emphasized that this partnership will enable the firm to better support the evolving needs of its advisors and their clients. The collaboration will focus on expanding resources in critical areas such as practice management, business continuity, and succession planning—key components for building sustainable advisory practices.

Leadership Statements on the Partnership

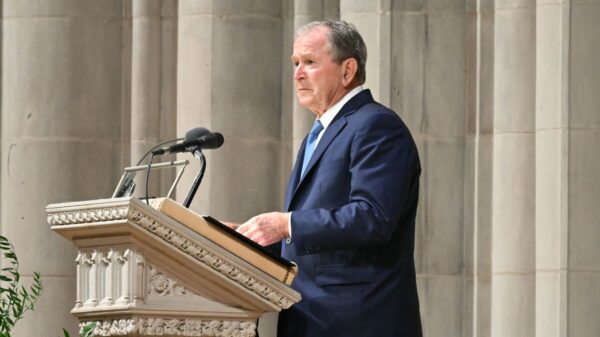

Adam Schorr, Chief Financial Officer at Private Advisor Group, expressed confidence in Republic Capital Group’s capabilities, stating, “Republic Capital Group has continually demonstrated strong due diligence and sound guidance. Their disciplined approach aligns well with our philosophy of making informed, well-supported decisions on behalf of the advisors we serve.”

John Langston, Founder and CEO of Republic Capital Group, congratulated the Private Advisor Group leadership team on this milestone, saying, “This alignment positions both firms to achieve much more in the days ahead.” Blake Cargill, Partner and Managing Director at Republic, noted, “It has been an honor to have served as advisors to Private Advisor Group to achieve this successful outcome with LPL. This is a milestone event in the industry, and we look forward to seeing their continued success with this partnership.”

In recent years, particularly following its partnership with Merchant in 2021, Private Advisor Group has made significant investments in technology, talent, and operational infrastructure, reflecting its commitment to an advisor-first philosophy. These initiatives aim to create a robust platform for financial advisors seeking both growth and long-term sustainability.

Moving forward, Private Advisor Group will maintain its independence while leveraging the strengths of LPL and Merchant to unlock future opportunities. This strategic partnership is poised to enhance support for its advisor community and facilitate the ongoing evolution of the firm.

For more information about Republic Capital Group and its services, please visit their website at republiccg.com.