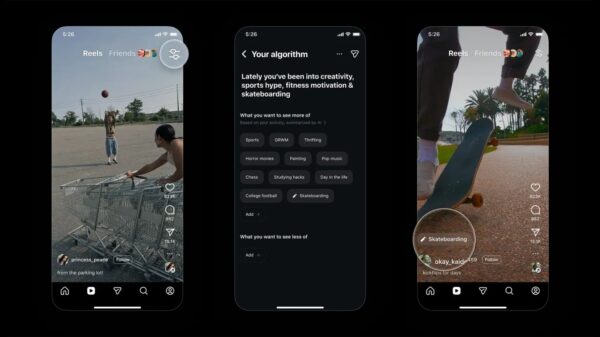

Meta Platforms (NASDAQ: META) received an upgraded price target of $850.00 from Morgan Stanley in a report published on July 30, 2023. This marks an increase from the previous target of $750.00 and reflects the brokerage’s continued confidence in the social media giant, maintaining an “overweight” rating on the stock.

Other financial institutions have also recently adjusted their price targets for Meta. On July 10, Bank of America raised its target from $690.00 to $765.00, issuing a “buy” rating. Likewise, Cantor Fitzgerald increased its price objective from $807.00 to $828.00, also giving an “overweight” rating on July 16. In addition, Truist Financial adjusted their price target from $700.00 to $720.00 with a “buy” rating.

Loop Capital set a new target at $888.00 on May 16, while JPMorgan Chase & Co. raised its target from $735.00 to $795.00 on July 11. The consensus from analysts indicates a robust outlook for Meta, with four holding a “hold” rating, thirty-nine issuing a “buy” rating, and three assigning a “strong buy.” According to data from MarketBeat.com, the average target price now stands at $820.32.

Recent Earnings Report Highlights

Meta Platforms reported its latest earnings on July 30, revealing a significant performance increase. The company achieved earnings per share of $7.14, exceeding analysts’ expectations of $5.75 by $1.39. Revenue for the quarter reached $47.52 billion, surpassing the consensus estimate of $44.55 billion. This marks a 21.6% increase in revenue compared to the same quarter last year, when earnings per share stood at $5.16. The company’s return on equity was recorded at 39.33% with a net margin of 39.99%.

Analysts project that Meta will post earnings of $26.70 per share for the current fiscal year, indicating strong future growth expectations.

Dividend Announcement and Insider Activity

Additionally, Meta Platforms announced a quarterly dividend of $0.525 per share, which was paid out on June 26, 2023. This represents an annualized dividend of $2.10 and a yield of 0.3%. The company’s payout ratio currently stands at 8.19%.

In terms of insider trading, Jennifer Newstead, an insider at Meta, sold 519 shares on July 29 at an average price of $719.86, totaling approximately $373,607.34. Following this transaction, Newstead holds 25,550 shares valued at around $18.39 million, reflecting a 1.99% decrease in ownership. Similarly, Director Robert M. Kimmitt sold 465 shares on July 15 at an average price of $723.08, resulting in a total of $336,232.20. After the sale, Kimmitt owned 9,342 shares with a value of approximately $6.76 million, marking a 4.74% decline in his holdings.

Over the last 90 days, insiders have sold a total of 152,980 shares of Meta stock worth about $105.71 million. Corporate insiders currently own 13.61% of the company’s stock, while institutional investors hold a substantial 79.91% of shares.

Institutional Investor Activity

Recent activity among institutional investors indicates a positive trend for Meta. Valley Financial Group Inc. increased its stake by 2.4% in the last quarter, owning 588 shares valued at $344,000. Lantern Wealth Advisors LLC raised its position by 0.5%, holding 2,976 shares worth approximately $1.74 million.

Pachira Investments Inc. and Hemington Wealth Management also boosted their stakes by 3.0% and 0.6%, respectively. Riverwater Partners LLC grew its holdings by 2.7%, now owning 572 shares valued at about $335,000.

As Meta Platforms continues its trajectory of growth and investor confidence, the company remains a focal point in the tech sector, with analysts and insiders alike keeping a close watch on its performance and market strategies.