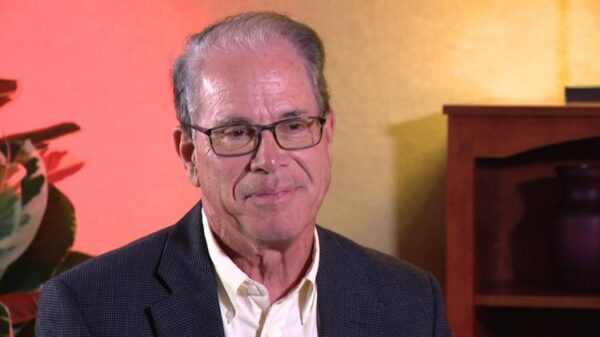

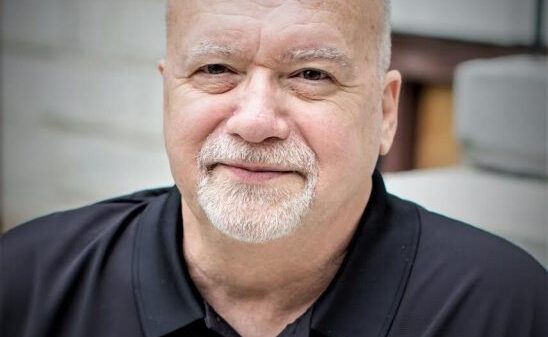

Hartford Financial Services Group, Inc. (NYSE: HIG) reported impressive earnings for the second quarter of 2025, achieving core earnings of nearly $1 billion or $3.41 per diluted share. This robust performance reflects the company’s effective strategy and operational execution, positioning it for continued growth in a competitive market. The results were announced during a conference call on July 29, 2025, led by Chairman and CEO Chris Swift and Chief Financial Officer Beth Costello.

During the earnings call, Swift highlighted a significant increase in core earnings, which reached $981 million, translating to a trailing 12-month core earnings return on equity (ROE) of 17%. The company’s strategic investments and focus on innovation have allowed it to capitalize on market opportunities while maintaining strong margins. Overall, the results underscore the strength of the Hartford’s various business segments.

Business Insurance and Growth Metrics

In the Business Insurance sector, Hartford saw an 8% increase in written premiums, with an underlying combined ratio of 88. The small business segment, in particular, performed exceptionally well, boasting a record-breaking quarterly net new business premium. Improvements in underwriting tools and data science have significantly enhanced the company’s competitive advantage. Swift noted that the ongoing investment in technology contributed to a seamless quoting process, allowing 75% of all quotes to be bound within minutes.

Looking ahead, Hartford is on track to exceed $6 billion in annual written premiums in 2025. The growth trajectory is supported by advancements in artificial intelligence (AI) and automation, which streamline operations and enhance efficiency across the organization.

Strong Performance in Personal Insurance and Employee Benefits

Hartford’s Personal Insurance segment also reported substantial gains, with an underlying combined ratio of 88 and 17% growth in written premiums in the homeowners category. The auto segment saw a notable improvement in performance, with the underlying combined ratio improving by 9.7 points. The company’s recent introduction of the Prevail offering, which combines auto, home, and umbrella insurance, aims to unlock further opportunities within the agency channel.

In the Employee Benefits division, Hartford achieved a core earnings margin of 9.2%, driven by solid results in life and disability insurance. The partnerships established, particularly with Nayya for AI-driven benefits enrollment, are expected to enhance the overall employee experience and benefit utilization.

The company also reported a net investment income of $664 million, reflecting an increase due to higher levels of invested assets and reinvestment at elevated interest rates.

Overall, Hartford Financial Services Group’s second-quarter results demonstrate a strong foundation for future growth, driven by strategic investments and a commitment to innovation. As the company continues to expand its market presence, it remains well-positioned to capture additional market share and deliver sustained profitability. Investors have expressed optimism regarding the company’s potential, evidenced by a favorable response during the earnings call and subsequent discussions.