Ford has launched its Universal EV Platform, a strategic initiative aimed at producing affordable electric vehicles (EVs) at scale. During the presentation on August 15, 2025, CEO Jim Farley characterized this venture as the company’s “Model T moment.” He emphasized the substantial commitment of $5 billion to this project, which focuses on simplified manufacturing processes and domestically sourced lithium iron phosphate (LFP) batteries. While Farley was optimistic, he acknowledged the inherent risks, stating that he could not guarantee success in the current unpredictable policy environment.

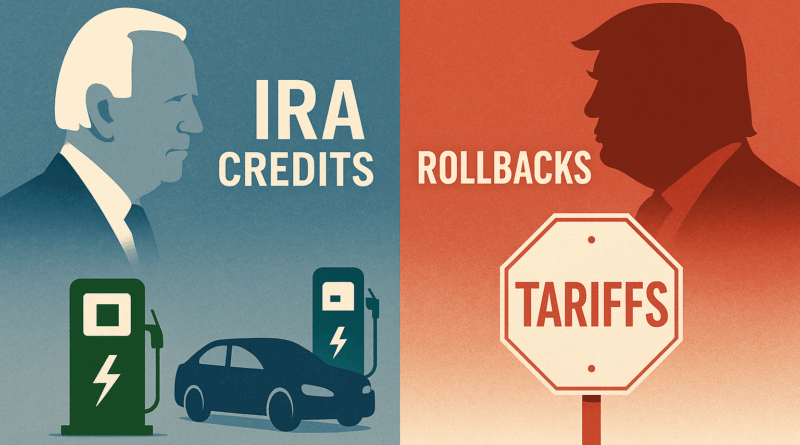

The backdrop for Ford’s ambitious plans includes a notable shift in U.S. policies regarding electric vehicles. Previously, under the Biden administration, the Inflation Reduction Act provided essential incentives, including $7,500 in consumer credits for qualifying EVs and significant funding for charging infrastructure. This support created an environment conducive to investment in EV technology and production. However, the recent policy changes implemented by the Trump administration have reversed many of these incentives, which poses challenges for Ford’s strategy.

Understanding the strategic framework is crucial. According to Richard Rumelt, a successful strategy involves a clear diagnosis of the situation, a guiding policy, and coherent actions that align with that policy. In the case of the Universal EV Platform, Ford’s initial diagnosis was robust. The company identified the need for a flexible and cost-effective EV architecture, supported by a favorable policy landscape.

The guiding policy during the earlier phases was clear: invest in advanced manufacturing techniques to reduce EV costs, establish local supply chains for critical components like LFP batteries, and design vehicles that offer a total cost of ownership competitive with gasoline-powered cars. Recognizing that cost, rather than technical feasibility, was the primary barrier to mainstream EV adoption, Ford’s leadership made the decision to move forward with the Universal EV Platform.

However, the political landscape has changed drastically. The elimination of consumer EV credits, reductions in funding for charging stations, and the introduction of tariffs on imported steel and aluminum have raised production costs. These developments have significant implications for Ford’s plans, particularly as the Universal EV Platform is designed to deliver affordable vehicles at scale. If these policies persist, the economic conditions that initially justified Ford’s investment may be severely undermined.

Farley and his team appear to be banking on a return to supportive policies. They continue to invest in tooling, battery plants, and supplier contracts, suggesting a belief that the political climate will shift back in favor of electrification before their new vehicles reach peak production. This approach reflects a coherent choice based on internal assessments predicting a future resurgence of EV incentives.

The engineering behind the Universal EV Platform is notable. It features structural LFP battery packs produced in Michigan, a streamlined assembly process that allows for parallel construction of vehicle modules, and a simplified wiring architecture that reduces complexity and potential failure points. These innovations aim to make production more efficient and cost-effective while maintaining the quality that consumers expect.

Despite these advancements, challenges remain. The base battery pack offers a capacity of approximately 51 kWh, which may not meet the demands of American consumers accustomed to long driving distances and extensive road trips. The lack of a robust charging infrastructure further complicates the appeal of shorter-range vehicles.

In international markets, the platform faces additional hurdles. The design is tailored for North American specifications, making it less suitable for narrower European roads and parking spaces. Competing EV manufacturers, such as BYD, already provide vehicles with greater range at lower prices, backed by their domestic supply chains. Consequently, Ford’s potential market for the Universal EV Platform may be limited primarily to the U.S. and possibly Canada.

Despite these hurdles, the Universal EV Platform could find success in the commercial vehicle sector, where total cost of ownership is often more critical than initial purchase price. Fleet operators in sectors such as utilities and delivery services may benefit from the platform’s simplified manufacturing and lower maintenance needs. The ability to customize the platform for various work-oriented body styles could further enhance its market appeal.

As Ford embarks on this high-stakes journey, it must contend with formidable competition. Rivals like Tesla, General Motors, and Toyota are also innovating and positioning themselves within the affordable EV market. Each competitor is pursuing unique cost-reduction strategies and leveraging established dealer networks, making the landscape increasingly competitive.

Ford’s current strategy represents a bold gamble in a time of uncertainty. Should the political environment pivot back toward supporting electric vehicle incentives, the Universal EV Platform could thrive in a market eager for affordable options. Conversely, if current challenges persist, Ford may struggle to sell vehicles that do not meet consumer expectations in terms of range and pricing.

In Rumelt’s framework, while Ford’s initial diagnosis, guiding policy, and coherent actions were aligned, the shifting political landscape has introduced complexities that could jeopardize the effectiveness of its strategy. Ford’s ability to execute this ambitious plan will be pivotal in determining whether its investment will yield the anticipated returns or become a cautionary tale in the EV market.