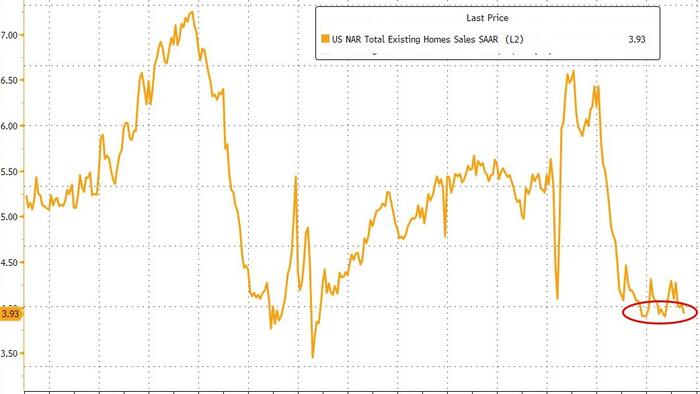

Existing home sales in the United States experienced a significant decline in June 2023, dropping by 2.7% month-over-month. This decrease follows a slight rebound in May, which had offered some hope after reaching a 15-year low. Analysts had anticipated this downturn, particularly as mortgage rates continued to rise, impacting buyer sentiment and market activity.

In June, the median sales price of existing homes hit a record high of $435,300, representing a 2% increase compared to the same month last year. Despite a recent uptick in housing inventory, home prices continue to escalate, largely due to years of insufficient supply. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), “Multiple years of undersupply are driving the record high home prices. Home construction continues to lag behind population growth.”

Yun emphasized that it is common to see elevated home prices during this time of year, as many families aim to relocate before the start of the school year. The current economic climate, however, has created a challenging environment for buyers. Recent analysis by Goldman Sachs revealed that approximately 87% of mortgage holders enjoy rates below current levels, with two-thirds holding rates that are 2 percentage points lower. This situation strongly discourages homeowners from selling, effectively keeping the housing market stagnant.

The reluctance to move is evident in the sales data, where only 21% of homes sold in June were above their list prices, a decrease from 28% in May. This suggests that buyers are hesitating to pay top dollar in a market characterized by inflated prices.

Political figures are also weighing in on the housing crisis. Former President Donald Trump criticized the current interest rate policies, stating, “Housing in our country is lagging because Jerome ‘Too Late’ Powell refuses to lower interest rates. Families are being hurt because interest rates are too high.” His remarks reflect broader concerns regarding how monetary policy is affecting the housing market and overall economic stability.

Yun further noted that, based on NAR’s analysis, a reduction in mortgage rates to 6% could potentially lead to an additional 500,000 home sales and enable around 160,000 renters to transition into first-time homeowners. The ongoing challenges in the housing market underscore the complex interplay between interest rates, supply, and demand, leaving many potential buyers in limbo.

As the market adjusts to these conditions, the coming months will be critical for determining whether sales can recover from this latest dip, or if high prices and elevated mortgage rates will continue to stifle activity. The situation remains fluid, and stakeholders across the real estate sector are watching closely for signs of change.