Cullen Investment Group LTD. has increased its stake in Broadcom Inc. by 3.4%, acquiring an additional 2,804 shares during the second quarter of 2023. The investment firm now holds a total of 84,170 shares in the semiconductor manufacturer, valued at approximately $23,201,000 according to its latest filing with the Securities and Exchange Commission (SEC). Broadcom represents about 3.3% of Cullen Investment Group’s overall portfolio, making it the seventh largest position in their holdings.

Several other institutional investors have also adjusted their positions in Broadcom. Waddell & Associates LLC enhanced its investment by 2.1% in the first quarter, bringing its total share ownership to 2,091, valued at $350,000. Challenger Wealth Management increased its holdings by 1.3%, resulting in ownership of 3,504 shares worth $587,000. Other firms, including True Wealth Design LLC and Wescott Financial Advisory Group LLC, also reported similar increases, indicating a robust interest in Broadcom among institutional investors.

Analyst Ratings and Stock Performance

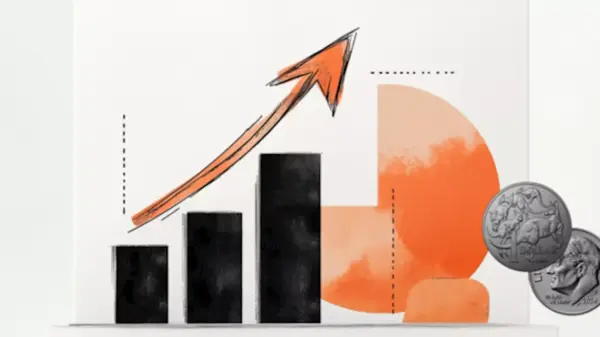

Analysts have recently expressed positive sentiments about Broadcom’s prospects. Truist Financial raised its price target from $295.00 to $365.00 and maintained a “buy” rating. Similarly, Wells Fargo & Company elevated its target from $255.00 to $345.00, assigning the stock an “equal weight” rating. HSBC upgraded Broadcom from “hold” to “buy” and set a price target of $400.00. The stock has received a favorable consensus rating, with three analysts providing a “Strong Buy” rating and a total of 28 analysts recommending a “Buy,” according to MarketBeat.

Broadcom’s stock opened at $359.87 recently, reflecting a significant upward trend. The stock’s 50-day moving average stands at $300.31, while the 200-day moving average is $241.98. Over the past year, Broadcom’s shares have fluctuated between a low of $138.10 and a high of $374.23. The company boasts a market capitalization of $1.69 trillion and has a debt-to-equity ratio of 0.86.

Recent Financial Results and Dividends

In its most recent earnings report on September 4, 2023, Broadcom announced earnings of $1.69 per share, exceeding analysts’ expectations of $1.66 by $0.03. The company reported revenue of $15.95 billion, which was above the projected $15.82 billion. This marks a 22.0% increase in revenue compared to the same quarter last year. Broadcom also provided optimistic guidance for the fourth quarter, projecting earnings of $5.38 per share for the current year.

Additionally, Broadcom recently declared a quarterly dividend of $0.59 per share, set to be paid on September 30, 2023, to shareholders of record as of September 22, 2023. This dividend represents an annualized yield of 0.7%, with a payout ratio of 60.20%.

In insider trading news, Director Gayla J. Delly sold 3,000 shares for a total of $795,390.00, decreasing her position by 8.25%. Another director, Justine Page, sold 800 shares for $245,968.00, representing a 3.25% reduction in ownership.

Overall, Broadcom Inc. continues to attract significant interest from both institutional investors and analysts, reflecting confidence in its long-term growth potential within the semiconductor industry.