Copper prices have rebounded significantly, with three-month futures on the London Metal Exchange settling at $11,556.50 per ton, marking an intraday gain of 0.6%. This resurgence comes amid fresh warnings regarding a potential supply shortage that could fail to meet increasing demand. Observers in the market are closely monitoring the implications of these developments for both investors and the broader economic landscape.

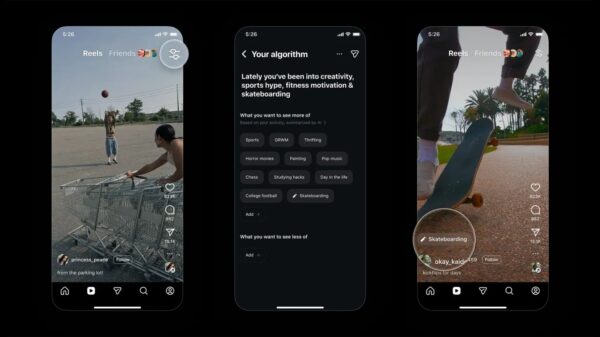

The recent rally in copper prices is attributed to a series of bullish forecasts concerning the metal’s long-term prospects. These predictions have been bolstered by interruptions in mining operations and rising expectations of a potential U.S. tariff on copper imports. In a recent note, RBC Capital Markets emphasized the necessity for higher prices to stimulate investment in new copper production, stating, “The mining industry struggles to build new supply.” The report also highlights the growing demand driven by advancements in artificial intelligence, electric vehicle (EV) expansion, and a global trend towards more accommodating economic policies.

Despite this optimism, copper prices had previously experienced a decline, falling by as much as 1.3% due to signs of slowing demand from China. New data indicated that Chinese producer prices have dropped for the 38th consecutive month, prompting concerns about the sustainability of global copper demand. Additionally, the market was unsettled ahead of the recent decision by the U.S. Federal Reserve regarding interest rates, which could significantly influence the economic outlook for the world’s largest economy going into 2024.

Geopolitical Factors and Market Dynamics

Geopolitical factors are also playing a critical role in the copper landscape. Indonesia has expressed resistance to U.S. trade deal demands, citing concerns that agreements could compromise its autonomy, particularly in crucial minerals and energy sectors. This resistance could have far-reaching implications for global supply chains, especially for metals essential to renewable energy technologies.

Meanwhile, the situation surrounding the Cobre Panama mine remains uncertain. The mine’s operator, First Quantum Minerals, has generated $29 million in royalties from copper concentrate sales, which will be allocated to essential public works projects in Panama. Commerce Minister Julio Moltó has confirmed that these funds will support improvements to health centers, educational facilities, and infrastructure, despite the mine’s current operational challenges.

In a related development, shareholder approvals have allowed Teck Resources and Anglo American to proceed with seeking regulatory approvals globally for their planned merger, which could create a major player in the copper market. Analysts, including Paul Wong, mention that the global silver inventory has reached a critical juncture, where additional demand is likely to affect pricing dynamics significantly.

The copper market’s trajectory is poised for further fluctuations as it balances between supply constraints and evolving demand patterns, amplified by technological advancements and international trade dynamics. As stakeholders navigate these complexities, the focus will remain on how effectively the industry can adapt to meet rising global needs.