The growing demand for instant payments faces significant challenges as banks remain cautious about offering full transaction capabilities. Despite the potential benefits for businesses and consumers, fears surrounding fraud have led many financial institutions to limit services primarily to “receive-only” options. This hesitance is particularly evident in the United States, where banks are wary of the risks associated with sending funds.

Concerns about fraud on instant payment networks, particularly in the context of authorized push payment (APP) scams, dominate discussions around the adoption of these systems. According to a report titled “Reality Check: Fact vs. Fiction in Real-Time Payments Fraud,” produced in collaboration with The Clearing House and PYMNTS Intelligence, banks acknowledge that while fraudulent activities do occur, the rates are significantly lower compared to traditional payment methods. Nonetheless, the perception of risk remains a barrier to broader implementation.

The report highlights that 85% of U.S. payment professionals anticipate an increase in fraud as instant payment systems expand. In particular, large firms employing over 50,000 individuals fear becoming prime targets, contributing to a cautious approach by banks. The study reveals that 78% of organizations have opted to start with receive-only functionalities, while only 22% have integrated both sending and receiving capabilities.

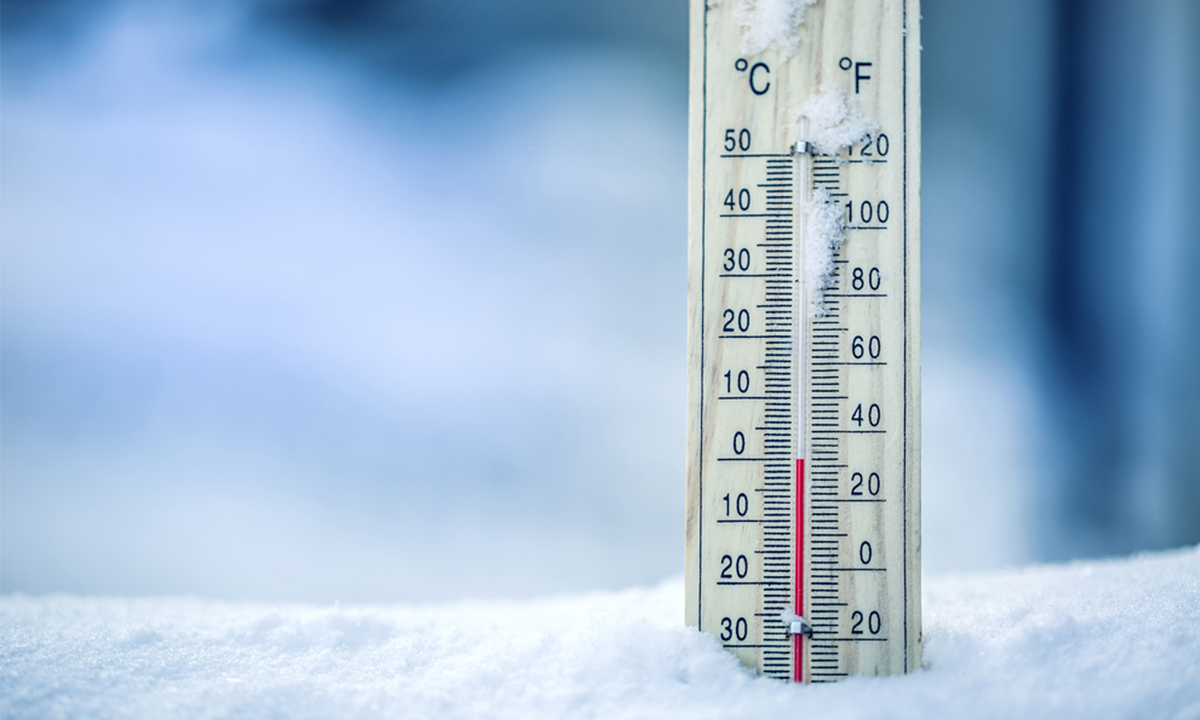

Banks’ concerns extend beyond just the specter of fraud; they are rooted in the potential for losing customer trust and facing regulatory scrutiny. Notably, a striking 63% of firms reported instances of check fraud in 2024, while only 2% indicated fraud linked to instant payment systems like RTP or FedNow. This paradox highlights a reliance on checks, despite the inherent risks associated with them.

While the fear of fraud persists, the actual rates remain low. In April alone, there were only 123 reported fraud cases from a staggering 35 million RTP transactions, illustrating that the risks associated with instant payments are minimal. Yet, this data does little to alleviate banks’ apprehensions, which can lead to a self-reinforcing cycle of limited service offerings and slower adoption rates.

Encouragingly, the financial sector is increasingly supportive of fraud prevention solutions. A vast 96% of banks endorse the implementation of Confirmation of Payee systems, which verify that the sender’s and recipient’s details match before a transfer is authorized. In the United Kingdom, such measures have successfully reduced APP fraud by 60%. Additionally, banks are seeking to incorporate artificial intelligence for anomaly detection, multifactor authentication, and real-time monitoring into their fraud prevention strategies.

Both The Clearing House and the Federal Reserve are actively enhancing their fraud defense mechanisms. They have launched a suite of tools, including real-time monitoring and scam classification frameworks, aimed at not only mitigating fraudulent activity but also fostering trust among users.

For instant payments to realize their full potential, financial institutions must address the gap between the perceived and actual risks associated with fraud. Although fraudulent activities will not disappear, they are considerably less common on real-time payment systems compared to traditional methods such as checks, wires, or Automated Clearing House (ACH) transactions. By embracing technology, adopting industry standards, and educating customers, banks can transition from receive-only services to comprehensive offerings without sacrificing safety.

The onus lies with the financial sector to dispel myths surrounding fraud and ensure that concerns about sending funds do not hinder the advancement of a faster and more secure payment ecosystem.