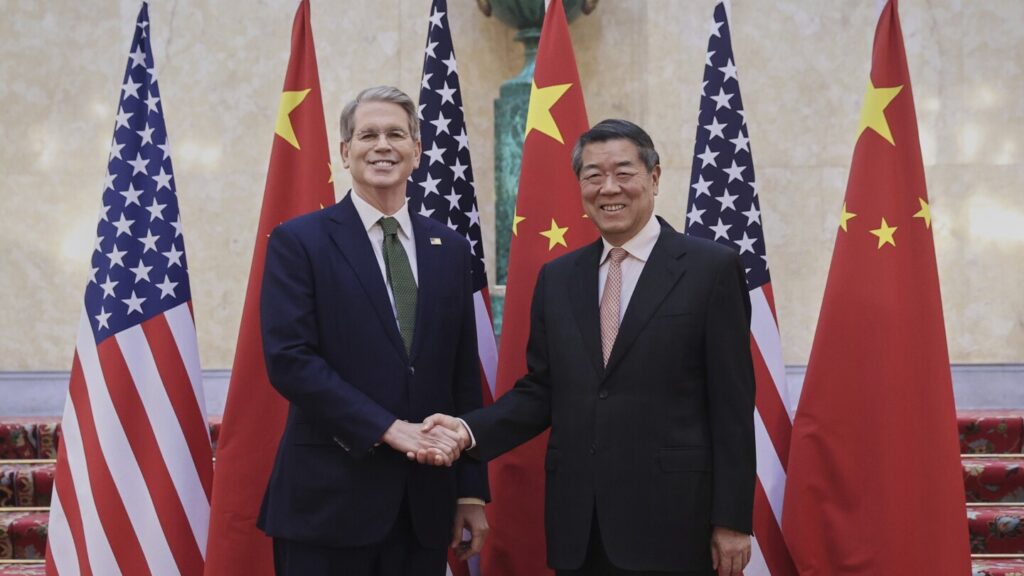

WASHINGTON — In a bid to ease ongoing trade tensions, the United States and China have reportedly reached a new agreement. However, the details remain vague, leaving many of the significant issues between the two economic powerhouses unresolved. President Donald Trump announced late Thursday that a deal had been signed “the other day,” while China’s Commerce Ministry confirmed on Friday that an arrangement had been reached, though specifics were scant.

The announcement comes as part of a broader pattern of sudden shifts and ambiguous policies that have characterized Trump’s approach to international trade since his return to the White House. Determined to challenge a global trading system he views as unfair to American workers, Trump has engaged in a prolonged trade battle with China, showcasing the economic pain both nations can inflict on each other. With a looming July 8 deadline to secure deals with other major U.S. trading partners, the stakes are high.

Key Details of the Agreement

U.S. Treasury Secretary Scott Bessent indicated on Friday that China had agreed to facilitate American firms’ access to Chinese magnets and rare earth minerals, which are crucial for manufacturing and microchip production. This move follows China’s previous slowdown of these exports amid the trade dispute with the Trump administration.

While the Chinese Commerce Ministry stated that “China will, in accordance with the law, review and approve eligible export applications for controlled items,” it did not explicitly mention U.S. access to rare earths. In return, the United States will lift certain restrictive measures imposed on China. However, the ministry did not clarify whether the U.S. would ease its controls on advanced technology exports to China.

“What we’re seeing here is a de-escalation under President Trump’s leadership,” Bessent remarked, though he did not detail the concessions made by the U.S. or address America’s export controls.

Jeff Moon, a former trade official in the Obama administration and current head of the China Moon Strategies consultancy, expressed skepticism about the lack of disclosed details. “Silence regarding the terms suggests that there is less substance to the deal than the Trump Administration implies,” Moon commented.

Historical Context and Previous Agreements

The recent agreement builds upon a “framework” announced by Trump on June 11, following high-level talks in London. At that time, China had agreed to ease restrictions on rare earths, and the U.S. pledged to halt efforts to revoke visas for Chinese students at American universities.

Last month, after discussions in Geneva, both countries agreed to scale back the hefty tariffs they had imposed on each other’s goods, which had soared to as high as 145% against China and 125% against the U.S. These tariffs had threatened to halt trade entirely and triggered a significant sell-off in financial markets. The Geneva talks resulted in reduced tariffs: America’s to 30% and China’s to 10%, setting the stage for the London talks and this week’s announcement.

Implications for U.S.-China Economic Relations

Despite the recent developments, the fundamental issues between the U.S. and China remain largely unaddressed. Eswar Prasad, a professor of trade policy at Cornell University, noted, “The U.S. and China appear to be easing the chokeholds they had on each other’s economies through export controls on computer chips and rare earth minerals, respectively. This is a positive step but a far cry from signaling prospects of a substantial de-escalation of tariffs and other trade hostilities.”

Trump’s trade war with China, initiated during his first term, has been marked by tariffs on most Chinese goods, driven by disputes over China’s attempts to challenge U.S. technological dominance. The U.S. has accused China of unfairly subsidizing its tech companies, coercing foreign firms to surrender sensitive technology, and engaging in outright theft of trade secrets.

“This week’s agreement includes absolutely nothing related to the U.S.’s concerns regarding China’s trade surplus or non-market behavior,” said Scott Kennedy of the Center for Strategic and International Studies. “If the two sides can implement these elements of the ceasefire, then they could begin negotiations on issues which generated the initial escalation in tensions in the first place.”

Broader Trade Strategy and Future Negotiations

Beyond the China deal, Trump has aggressively utilized tariffs since returning to the White House. In addition to levies on China, he has imposed a “baseline” 10% tax on imports from all countries and announced higher “reciprocal tariffs” ranging from 11% to 50% on nations with which the U.S. runs a trade deficit. However, after market fears of global trade disruption, Trump suspended these reciprocal levies for 90 days, allowing time for negotiation.

On Friday, Bessent suggested that talks could extend beyond the July 8 deadline, potentially concluding by Labor Day, with discussions involving 10 to 12 of America’s most significant trading partners. Trump downplayed the deadline, emphasizing ongoing negotiations and hinting at a forthcoming letter outlining trade terms for conducting business in the U.S.

In a separate development, Trump abruptly targeted Canada, announcing a suspension of trade talks over Canada’s impending digital services tax on technology firms like Amazon, Google, and Meta. This tax, set at 3% of revenue from Canadian users, will apply retroactively, potentially costing U.S. companies $2 billion by the month’s end.

As the global trade landscape continues to shift, the implications of these agreements and negotiations remain uncertain, with significant challenges still ahead for U.S. economic diplomacy.